DoorDash: Why the stock is plummeting (NYSE: DASH)

Michael M. Santiago/Getty Images News

In my last article about DoorDash (DASH) and its acquisition of Wolt, I warned that this acquisition could be a red flag:

“I think this acquisition may indicate that the risk/reward ratio of DoorDash’s stock is less favorable than before, and therefore management believes this is a good time to diversify the business.”

Since that statement, DoorDash shares have started to fall at a pace that I personally didn’t even expect.

DoorDash isn’t just a food delivery platform, it’s a platform to deliver everything, especially food, groceries, and other necessities. Generally known as the last mile delivery market. But as it enters this market, DoorDash is beginning to rival the big winners of the past few decades.

3 years from Challenger to Dominance

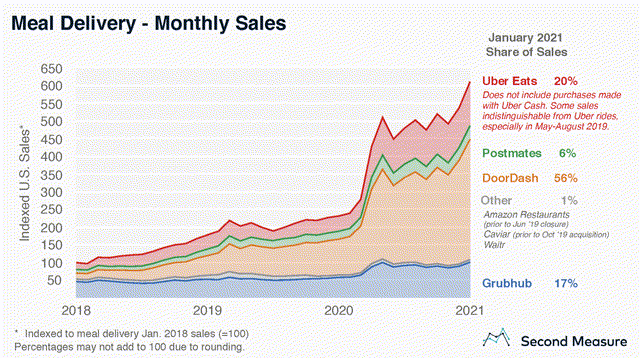

Second measure

This is the graph that beautifully shows how DoorDash in a relatively short time has gained a leading position in the food delivery industry. However, this graph does not show the underlying market shares by region which differ enormously.

Also, it doesn’t reflect the reality that DoorDash’s biggest competitors aren’t Uber. (NYSE: UBER) and Grubhub (NASDAQ: GRUB) but walmart (NYSE: WMT) and Amazon (NASDAQ:AMZN). As DoorDash has gone into the business of delivering virtually everything from merchants to your doorstep in say 1 hour; the competitive landscape is also changing. And it is far but certain that DoorDash will become the market leader in last mile delivery. As DoorDash begins to compete with Amazon and Walmart, an entry for these two into food delivery isn’t out of the question.

The competition

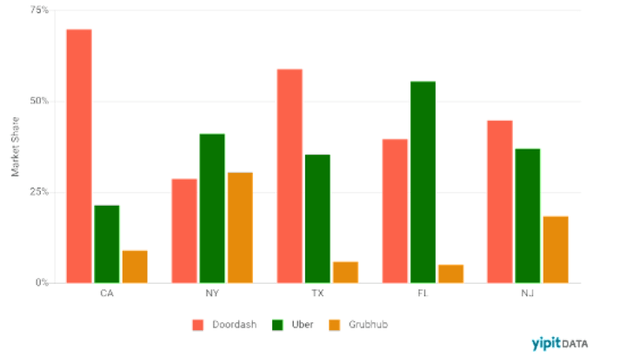

(Source: Yipitdata)

Contrary to popular belief, DoorDash has not won food delivery in the all WE. Take Manhattan: In Manhattan, DoorDash operates a 15% market share, which doesn’t strike me as a profitable share. As food delivery is a business with local network effects; people living in Manhattan will likely download the Grubhub app because it has the largest selection of restaurants in the area. Cool that DoorDash has the best deal in California, but that’s further than Bermuda – 4 times further in fact. Another example, according to Yipitdata, Uber Eats has the highest gross market value in Florida and New York. What I mean: America is very diverse, and DoorDash’s dominance in some areas doesn’t guarantee dominance in others. Reality: Uber Eats and Grubhub are strong competitors in most major cities outside of California. DoorDash may dominate food delivery in the suburbs of the US and California, but the suburbs are also the area with the most quick service restaurants. I note that Walmart is also a relatively well-known grocery chain with a 26% market share in groceries – which is mostly focused on the suburbs.

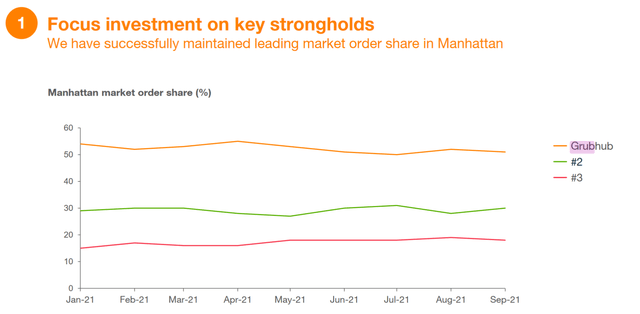

(Source: JustEatTakeaway.com)

DoorDash doesn’t dominate the same-day delivery market either. With an expected GOV of $40 billion for DoorDash by 2021, competitors like Instacart (ICART) are nearly as big (estimated at $30 billion). Instacart is a same-day grocery delivery platform, but since DoorDash is entering this market, it’s fair to consider Instacart as a competitor.

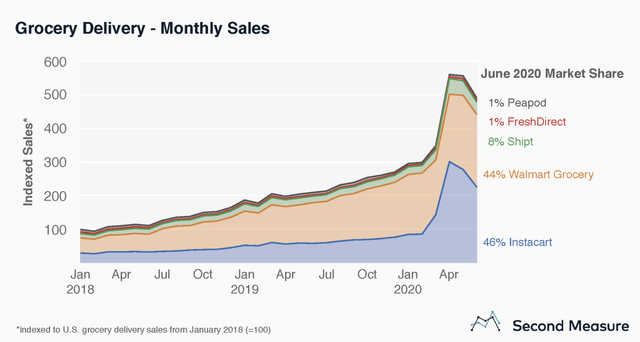

(Source: SecondMeasure)

Also not unimportant, Amazon has a 40% market share in e-commerce and its vision is to be the online place to buy everything. As explained in my Amazon article, Amazon’s supposed entry into the same-day (grocery) delivery market is a huge long-term risk for same-day delivery companies like DoorDash. My point is clear, there is a lot of competition.

The interesting fact is that the logistics of the same delivery market and the food delivery market overlap. It’s clear that competition in the same-day delivery market is strong and growing, so it makes sense for these platforms to venture into food delivery to provide a competitive deal to customers.

Giants

In the short term, what worries me the most about DoorDash’s prospects is the fact that Just Eat Takeaway is practically putting Grubhub up for sale through a “partnership”, whatever a partnership might entail. More recently, there has also been speculation about a potential sale of Grubhub. I’ve written extensively about Just Eat Takeaway but the potential consequences can be detrimental to DoorDash.

Just Eat Takeaway Grubhub CEO Jitse Groen said at the end of the Q4 2021 partnership call that “there could be some really big consumer brands interested,” I think the meaning of those words is clear. With Walmart (and eventually Amazon) moving into the same-day grocery delivery market, adding serious food delivery to the offering can be extremely valuable. If Amazon legitimately gets into food delivery, DoorDash’s stock may drop much further.

DoorDash’s vision

DoorDash aims to be the logistics hub for delivering a wide range of goods, but for now, obviously, it’s mostly food. Some readers ask me: what is the gap here? I think the fluke is valuable network effects that users experience as the supply of available merchants, consumers, and drivers increases. Think about features like short shipping times, lowest shipping costs, best possible product selection, and other small features like ratings. Consumers want the best experience; I imagine that only a few platforms can potentially cost-effectively provide adequate customer experience in the same-day delivery market. Finally, the large pool of drivers provides customers with their goods with consistently short delivery times, while the large pool of consumers offers drivers a high occupancy rate. In other words, when drivers switch to another platform, they may end up idling, which is an obvious waste of time, and consumers have to wait longer for their goods on the other platform. . In my opinion, this is a gap.

That’s why I suspect that DoorDash over time – if it runs successfully – can earn high returns on invested capital. With a 9 EV/sales ratio, forward revenue growth rate of 90% and gross profit margin of 50% – DoorDash is actually quite cheap compared to other publicly traded platforms like Airbnb (NASDAQ: ABNB) or Snap (NYSE:SNAP). Because DoorDash operates a logistics platform and does not employ drivers, they can earn long-term gross profit margins similar to Airbnb and Snap. I conclude that DoorDash with higher revenue growth rate but lower multiples is riskier by the market.

If we assume profit margins of 30% and a CAGR of 35% for 2026, we are looking at profits of $6.1 billion. With a P/E ratio of 50, that would value the company at $300 billion. The upside is clear, but the question is whether DoorDash will ever turn a profit.

To take with

The market is rightly starting to wonder about the prospects of this company. If management achieves its goals, this stock is a potential 10 baggers. But with the Amazon juggernaut snooping around the same-day delivery market, I seriously wonder if the company will ever achieve its goals.

Comments are closed.