Airbnb stock: turn off the lights (NASDAQ: ABNB)

Another hotel smoked out by Airbnb’s deflationary wave Bertrand Godfroid/iStock Editorial via Getty Images

DISCLAIMER: This notice is intended for US recipients only and, in particular, is not intended for, or intended to be relied upon by, UK recipients. Any information or analysis contained in this note does not constitute an offer to sell or the solicitation of an offer to buy securities. Nothing in this rating is intended to be investment advice nor should it be relied upon in making investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may hold a position in stocks, securities or financial instruments referenced in this note. Any opinions, analyzes or probabilities expressed in this note are those of the author as of the date of publication of the note and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be clients of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe this presents a conflict of interest. significant potential or affects the content of its research or publications.

What’s not to like?

Airbnb (NASDAQ: ABNB) is one of our favorite stocks in our coverage universe and our employees’ personal accounts. It’s been a great performer for us in both the common stock and LEAP incarnations (the latter being due to one of our subscribers who had the brilliant idea of buying the $120 strike Jan-23 calls LEAP a long time ago, and has been good enough to share the idea with the rest of our community). We believe the stock has decades of price growth ahead of it.

We like ABNB because it offers a way to play two themes:

First, the online deflation of an old fashioned industry, the hospitality industry. This theme never gets old. And when it does, it will be because Metaverse’s immersive internet companies deflate the current offline business idiom with online offerings. So many decades of growth left in this chart, we think. The Internet Tsunami has destroyed many aspects of many industries, but there is still a lot of land to go and ruin.

And second, reopening travel as COVID restrictions continue to evaporate. COVID itself, we expect it to be with us for a long time, but governments’ ability and desire to manage it is wearing thin day by day, and with that, we’re seeing more travel bookings , more mileage driven, more spending through the ABNB platform, which we believe is good for the stock.

The company just put on a quarterback that, in our professional, institutionally trained, appeased, and moderated opinion, was…absolutely stunning!

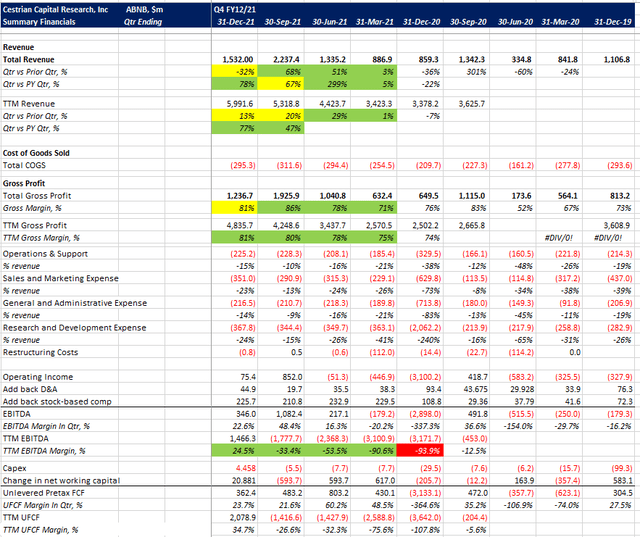

Numbers as follows:

ABNB I financial chart (company SEC filings, YCharts.com, Cestrian analysis) ABNB II financial chart (company SEC filings, YCharts.com, Cestrian analysis)

Note the accelerating revenue growth, strong gross margins, now positive TTM EBITDA margin and now positive TTM unleveraged pretax free cash flow margins. Next time someone tells you it’s over for growth stocks and you should buy stocks with profits? Show them ABNB’s cash flow. And just laugh when they mumble something about EPS.

Evaluation?

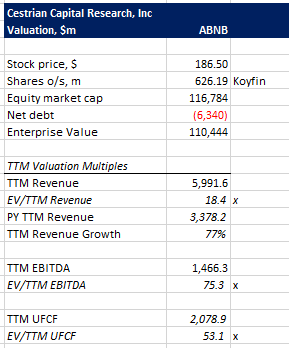

The market is asking you to pay the following multiples right now:

ABNB Rating Chart (Company SEC Filings, YCharts.com, Koyfin, Cestrian Analysis)

18.4x TTM revenue for a company growing 77% in revenue on a TTM basis, generating 34% unleveraged pre-tax cash flow margins? It’s not expensive in our opinion.

What if we look at how the graph unfolds? (Here is a full page version you can open).

ABNB Stock Chart (TradingView, Cestrian Analysis)

We believe ABNB can reach new highs in the coming months – that means $212 or more, a 14% increase from here, as a base case. And if you pushed us, we’d probably say the stock can hit $266 before the risk of a major downturn – that’s the 1.618 extension from the previous wave 1 upside shown on the chart above.

In short – we are bullish on this name and hold the stock in personal staff accounts accordingly. We rate the stock Neutral based solely on the risk/reward ratio. Our mid-term base scenario is only 14% from here, but the chart will tell you – if you ask nicely and look at the Fibonacci extension levels that have been hit recently – that the stock could easily drop to around $153 if the market gets ugly again. After experiencing the April 2021 false dawn after the March 2021 growth stock lows – which led to a May 2021 rout of unsuspecting naive people – we still don’t feel like saying growth is out of the woods. The deal – more testing of the dips would come as no surprise to us – and so an 18% downside/14% base case risk/reward doesn’t look much like a buy to us. (We were at Buy – vocally – in our Pro Growth Investor service while the stock was much lower in January and early February). So – Neutral, but we’ll definitely go back to long if the stock shows any weakness. The chart above can help you navigate our view of risk/reward and the levels at which our analysis indicates a buy.

Cestrian Capital Research, Inc – February 15, 2022.

Comments are closed.