And so on the cycle

form load

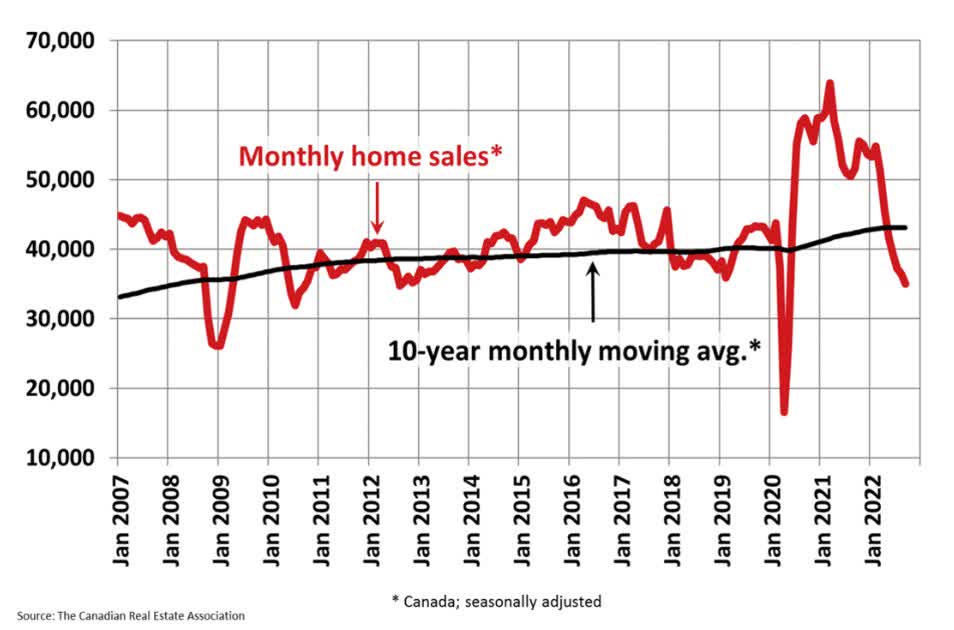

Monthly home sales in Canada in September were -32% year-over-year and 12% below the pre-pandemic 10-year average for September (graph below from 2007, courtesy of Martin Pelletier). October sales appear to have been worse.

Many of those who purchased properties during the 2020-2022 frenzy is now underwater in terms of resale value. Others have refinanced existing properties to extract equity that has since been spent. Private mortgages are harder to come by as many previous providers borrowed funds from their own properties to lend to others and are now suffering too.

Yet, as evidenced by this GTA billboard below, the hope is eternal that “Toronto shoppers” will continue to have more access to credit than math skills. Ah, the good old days.

In the 2020-22 fear of missing out (FOMO), approximately 40% of purchases in the United States and Canada were second homes purchased for “investment”, occasional use and short-term rental. Suddenly, negative carry turned deadly due to rising utility and mortgage spending. At the same time, rent disinflation is expected to accelerate as more landlords seek short- and long-term tenants. An estimated 50% of Airbnb rental listings have been added in the past two years.

With housing costs accounting for a third of the consumer price index (CPI), central banks need deflation to bring the CPI back to target; and they begin to succeed. Their too-loose policies for too long have allowed the inflation they want to kill, but that’s news yesterday.

On the commercial side, a survey of 7 million American small businesses found that 37% could not pay their rent in full in October, compared to 30% in September. See Bloomberg: More than a third of American small businesses were unable to pay their rent in October. About 49% of restaurants could not pay their rent, as well as 37% of real estate agents.

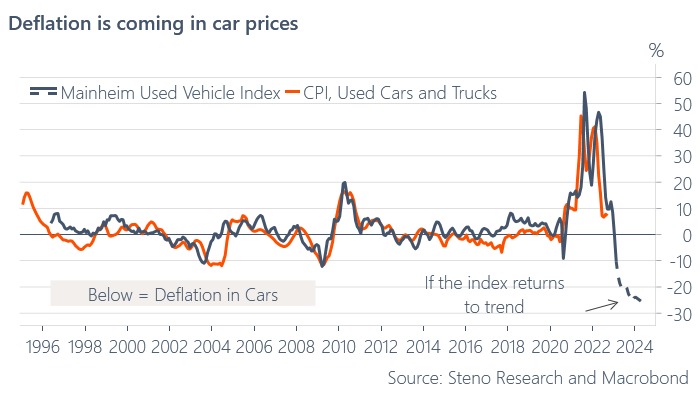

Next is the increase in car loans and loan defaults, especially on the more expensive brands. It is typical for auto inventories to rise during recessions. But like the math-free purchases in real estate over the past two years, the financial harakiri in the automotive space has also been extra-extraordinary. As shown below, since 1996, the parabolic prices from 2020 to 2022 are reverting to the mean and suggest that prices should continue to fall through 2024. Undoubtedly, some of the advanced loans in this mess will not will not prove that the money is good.

On the positive side, much lower housing and transportation costs will improve productivity and financial viability. In time, clearance prices will help fuel the next rally from the ashes of the ongoing collapse. And so on the cycle.

Disclosure: No post.

Editor’s note: The summary bullet points for this article were chosen by the Seeking Alpha editors.

Comments are closed.