Kazaks say rates still need to rise ‘significantly’: ECB update

(Bloomberg) – European Central Bank President Christine Lagarde has warned that a “mild recession” is possible, but that alone would not be enough to stem soaring prices.

Speaking a week after the ECB’s second consecutive 75 basis point hike in borrowing costs, and as fears grow that the energy crisis will drive down output in the eurozone to 19 countries, Lagarde said: “We don’t think this recession will be able to bring inflation under control.

Although a contraction is not his “baseline” scenario, Lagarde’s Latvian colleague Martins Kazaks said he expects one in the coming months. Fabio Panetta, member of the executive board, warned of the economic risks of a rapid rise in rates.

The comments are part of a series of public appearances by ECB officials as investors and analysts ponder the twin challenges of record price growth and a likely economic slowdown, driven in large part by the invasion of Ukraine by Russia.

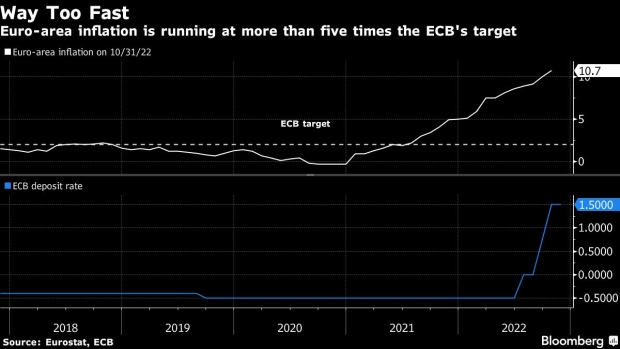

Seven of the 25 members of the Governing Council spoke on Thursday, days after data showed consumer prices jumped 10.7% in October, more than expected and more than five times the official target . The focus is now on action next month at the final policy meeting of 2022, with hawks and doves agreeing further hikes are needed.

It’s not just rates, which doubled to 1.5% last month in the most aggressive monetary tightening cycle in ECB history, but which still lag those of United States. Officials are also debating how to reduce the roughly 5 trillion euros ($4.9 trillion) in bonds bought for stimulus purposes during recent crises. The plan is for the December meeting to agree on this process, known as quantitative tightening.

Key developments

- ECB’s Makhlouf says it’s too early to specify size of next rate hike

- Eurozone factory slowdown intensifies on record inflation

- ECB still has a long way to go on rates, say Nagel and De Cos

Click on TECO to learn more about today’s top economic news. See BECO for analysis from Bloomberg Economics and click here to subscribe to our New Economy Daily newsletter.

Centeno of Portugal (4:05 p.m.)

The ECB has raised interest rates to a level much closer to the level that neither stimulates nor constrains the economy, according to Mario Centeno, a member of the Governing Council.

But while some of his Governing Council colleagues have focused on the so-called neutral rate, Centeno said the key for now is for inflation to peak, likely in the first quarter.

After that, he told the Bloomberg Portugal Capital Markets Forum in Lisbon on Thursday, monetary policy will become easier and more predictable.

Centeno said war, not rate hikes, are the main downside risks and that shallow recessions “are very difficult to conceive of.” He said a severe downturn can still be avoided, but it’s important not to let price expectations come off.

“We really need to act not to unanchor medium-term inflation expectations,” he said.

From Cos from Spain (1:20 p.m.)

European banks should remain cautious and increase their resilience in anticipation of an economic slowdown, according to Pablo Hernandez de Cos, member of the Governing Council of the European Central Bank.

As lenders see their profits rise thanks to higher rates, financial institutions should expect a slowdown in activity increasing the stock of bad debts, de Cos said at an event in Madrid.

Visco from Italy (12h)

Italy’s central bank governor Ignazio Visco said the 3% peak in the ECB’s rate hike cycle, currently priced in by markets, is “a possibility.”

“That’s within the range of rates we could achieve,” Visco said at an online event. Although analysts consider the ECB to be behind on the fight against record inflation, he said he did not believe officials acted too late.

“I don’t think we started late,” he said. “Even in September, we were still seeing core inflation well below our targets.”

The Federal Reserve started raising rates earlier than the ECB and was more aggressive. Visco said he doesn’t think “we should really expect to react the way the Fed did.”

Discussing Italy’s borrowing costs, Visco said the spread over German bonds “is still too high”.

Centeno of Portugal (9:30 a.m.)

Inflation that is ‘too high for a long time’, even when driven by supply-side factors, must be ‘tackled’ so ECB policy does not lose credibility, says Mario Centeno , member of the Board of Governors, in an interview with the Portuguese newspaper Publico.

“The policy we are setting is not about controlling inflation tomorrow or next month,” he said. “The objective is to control inflation in the medium term. This is what is in the mandate of the ECB.

Centeno, who also heads the Bank of Portugal, said demand was among other factors contributing to inflation as households and businesses deploy large savings in the era of the pandemic and the labor market remains solid.

“We can expect that when inflation peaks, and that is expected to happen in the fourth quarter of this year, a very significant degree of monetary policy predictability will be achieved.”

Bundesbank Nagel (9:20 a.m.)

Bundesbank President Joachim Nagel said that while political pressure may mount as the ECB continues to tighten monetary policy, that shouldn’t stop it from holding off on further rate hikes.

“Political pressure could increase over time as long as we are in this rate hike process,” the ECB Governing Council member said at an event in Madrid. “We should not refrain from further rate hikes.”

While acknowledging the need for further increases, he said the ECB was on a journey and he would not speculate on the end.

The euro zone is in a much better position than after the financial crisis, according to Nagel, who said he does not expect a hard landing for the continent next year.

Discussing future ECB balance sheet reductions, Nagel said the process should be “credible”.

The so-called quantitative tightening should be smooth without hurting markets, he said, adding that one way to go would be not to replace maturing assets.

ECB Lagarde (9:05 a.m.)

Lagarde also said officials need to be mindful of the ripple effects of rapid interest rate increases enacted by the Federal Reserve.

“We have to be mindful of each other and we have to be mindful of the potential fallout and return, because I think the Fed is also aware of that,” she told a conference in Riga, Latvia, on day after the Fed’s last three events. a quarter point increase.

“Each of us, just like the ECB, has its respective mandate, and while we have to take into account things like the Fed’s monetary policy decisions and other things of an international nature that will help us determine the best monetary policy, we are not alike and we cannot advance at the same pace, and with the same diagnosis of our economies.

ECB Panetta (9 a.m.)

ECB executive board member Fabio Panetta warned of unintended consequences as officials rapidly raise rates.

Speaking at the ECB’s money market conference, Panetta said the monetary policy stance is clear and further “adjustment” is warranted to keep inflation expectations anchored and avoid the effects. second round. But he said the calibration of the ECB’s stance should not be based on a “one-sided view” of risks.

“We will need to carefully consider the resilience of our economy, the implications of global monetary fallout and emerging threats to financial stability,” he said. “Let us therefore be careful about the adjustment stage of our monetary policy, so that we can continue to weather the current shocks and return the economy to price stability and solid growth.”

Latvian Kazaks (8h50)

Rate hikes will have to continue until 2023, according to the Kazaks, members of the Governing Council of the ECB.

“It is clear that interest rates will have to rise much more to bring inflation back to the 2% medium-term target,” he said at the opening of a conference in Riga. “There is no need to stop at the turn of the year. Rate increases must continue into next year – until inflation, especially core inflation, shows a visible slowdown.

And this despite the growing risks of an economic slowdown in Europe.

“In my view, the eurozone recession is a baseline scenario, but so far it’s likely to be relatively shallow and brief,” Kazaks said. “And therefore insufficient to break the backbone of persistent inflation.”

Latvian Kazaks (6h50)

The ECB still needs to raise borrowing costs “significantly” to cope with a record price spike, even if the euro zone is likely to slide into a recession, according to Governing Council member Martins Kazaks.

“Interest rates will still rise significantly,” Kazaks said. “Of course, the uncertainty is very high, especially regarding the war in Ukraine. Other central banks are also raising interest rates to slow inflation.

The Kazaks warned that lending is set to become more expensive even after the ECB made consecutive rate hikes of 75 basis points.

“For borrowers where the euribor is important, it will become more expensive,” he told Latvian TV channel LNT.

–With help from Joao Lima, James Regan, Alonso Soto, Bryce Baschuk and Flavia Rotondi.

©2022 Bloomberg LP

Comments are closed.