The next generation of ghost kitchens is emerging from the shadows

At the height of the pandemic, when dining rooms were closed, the phrase “ghost kitchen” entered the public lexicon and new “hot”-only delivery concepts opened their hidden doors almost daily.

But as the post-pandemic dust settles, the offsite restaurant industry is moving beyond the rush to celebrity-backed chicken nugget concepts. Virtual catering companies are here for the long haul: they’re stepping out of the shadows of the dark kitchen to combine off-and-on-site experiences, and many avoid the term “ghost kitchen” altogether.

“It feels like 2020 there was a big gold rush and now everyone is trying to grab the viral hit of MrBeast Burger,” said Markus Pinyero, co-founder of upcoming virtual food hall Oomi Kitchen. , referring to the Virtual Dining Concepts brand. “[…] We want people to order our food instead of ordering a burger from an influencer that you post on your Instagram and never order again. The return rate on some of these virtual brands is practically non-existent.

Oomi is a newcomer to the burgeoning delivery-only restaurant space, which includes multi-brand shadow kitchen curators, delivery-only concepts that operate in physical restaurants, and virtual food halls that house several original concepts and licensed into one. place. But Pinyero doesn’t feel behind in the game. In fact, he takes notes and learns from the mistakes of others.

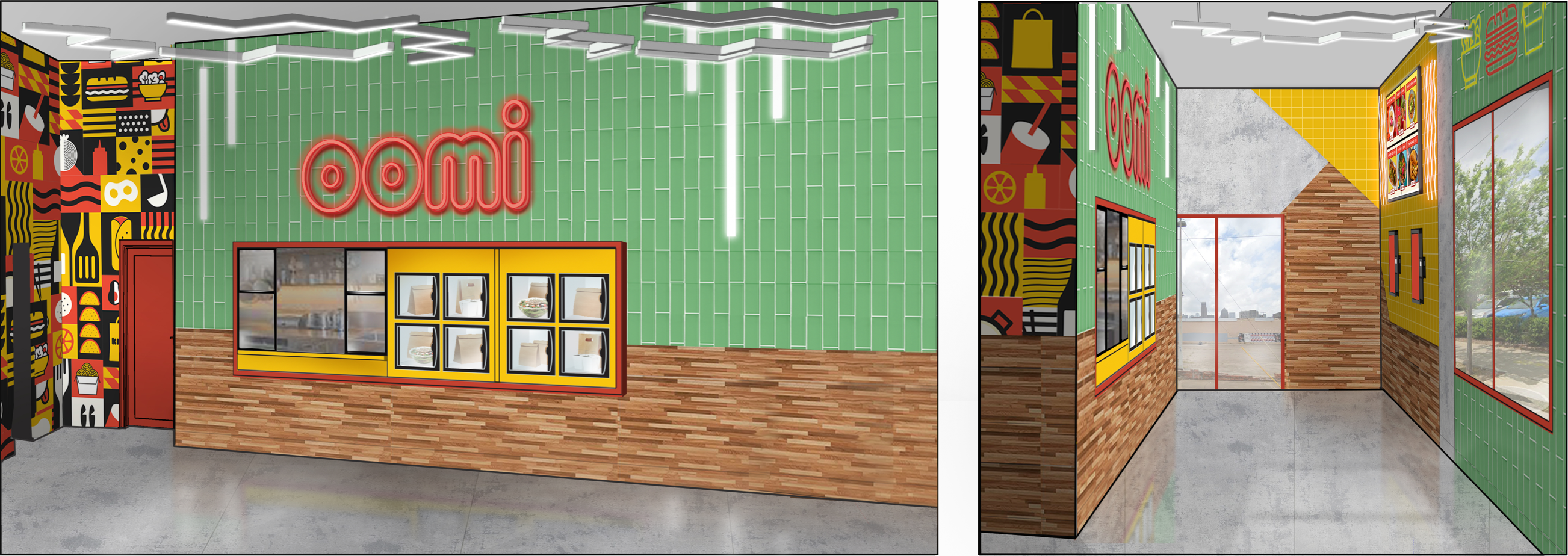

While the first generation of ghost kitchens may have been hidden behind closed doors and delivery app menus, Pinyero is encouraging customers to visit the neon-lit Oomi virtual food hall which will open in a few weeks at Dallas, where they can order from multiple brands at once. and collect their food from a food locker.

“We’re in the middle of a high-density area with extreme visibility, so we’re much more responsive to customers than many other ghost kitchens,” he said. “It’s much more joyful and hospitable that way instead of walking around the back of a creepy warehouse. We’re very open and brand-centric.

Oomi further differentiates itself by focusing on food quality and hospitality first and technology second. The company has its own trained culinary staff for original and licensed brands, including Which Which, FlyRite Chicken and Pinyero’s own brand, Urban Taco. They don’t franchise or license these concepts for backend operations because they want to oversee quality control.

“A lot of ghost kitchens may have frozen burger patties and pre-made sauces that you can just heat up and put in a delivery bag, but our brands are meant to operate like real restaurants,” Pinyero said.

Transparency seems to be a recurring theme among the next generation of virtual restaurant businesses. Meal Outpost is a more traditional type of virtual branded company that launched in June with operators in Austin, Miami, Charlotte, Durham, Washington, DC and Philadelphia. The company is making waves in the ghost kitchen space with an all-new operating model that costs restaurants nothing to sign up. Restaurants need only source their own food of choice from pre-existing emerging brands like Junzi Kitchen and Mono Mono, using labor from their own restaurant kitchens. The licensor then receives a percentage of the monthly revenue.

Meal Outpost is totally committed to making dark kitchens stand out in the light of day. As a restaurant host, you can register on the Meal Outpost website, see and read what brands are available in your area, and filter your search by cuisine and what type of equipment is needed to operate the brand. Then you fill out a form, upload photos of your kitchen space, and once you’re approved, you can start operating as a ghost kitchen.

“We wanted to create a very user-friendly and transparent platform where anyone can do it themselves,” said Dustin Mares, co-founder of Meal Outpost. “We tried to imitate an Airbnb website. […] it is a simple and searchable market […] Once operators sign up, we call and walk them through the remaining steps, send out training videos, and schedule their launch date. »

Mares also believes in the importance of working with established or proven brands to avoid “one-star Google reviews” from the multitude of “made-up concepts” that were launched during the height of the ghost kitchen boom.

As the virtual restaurant industry continues to evolve, even the most seasoned companies in the industry must keep up with changing customer needs. Bigger companies like Kitchen United, C3, Reef and NextBite are now focusing on logistical perfection. When Reef Technology started as a shadow kitchen subsidiary of a parking solutions company, they owned all the infrastructure, the workforce, and the kitchens, and now they’ve evolved to become more flexible. Now Reef is working with third-party companies and focusing on multi-brand locations, like launching the company’s first-ever virtual food hall inside an airport that opened in Raleigh, North Carolina. , this summer.

As Reef has received some negative attention and critical headlines For leaving specific cities and severing ties with bigger brands like Burger King and Jack in the Box, Reef rep Mason Harrison says the company’s shift to multi-brand locations is a reasonable explanation.

“We tried to show [the brands we partner with] that flexibility is an important part of this industry,” he said. “Most brands fell on our side of the fence, and error rates went down while ratings went up when we were able to focus on multi-brand ships.”

However, many large restaurant brands wanted more control over their presence in the ghost kitchen and wanted to be the only brand in a specific location. But for Reef, it makes sense to become more efficient and flexible as time passes and resources become more expensive. Looking ahead, Harrison sees Reef broadening its definition of operations to become more of a mix of franchise locations, local restaurants and insurgent virtual brands, as well as a presence in less conventional locations.

“The future for Reef will be where a new location could be inside a hotel where they leverage a few of our brands and use our technology,” Harrison said. “Over the past year, Reef has moved from five-fold growth and penetration into as many markets as possible, to focusing on our most profitable markets and models and to investing in new vessels. or associate with a hotel or airport.”

Similarly, veteran virtual restaurant company Nextbite is taking time at this point in its lifespan to focus on leaner asset utilization and use data and analytics to determine where and when to build its next brand of delivery only.

“A lot of the first wave of ghost kitchens realized it was very difficult to sustain a successful business with a 100% offsite model,” said Nextbite CEO Alex Canter. “A lot of them have moved to a more hybrid approach where your brands are available for delivery but also have a walk-in component. They’ve taken this omnichannel approach, and it makes a lot of sense.”

Nextbite keeps its operations simple: the company does not build new real estate or open new commissary kitchens: it operates with restaurants to allow them to sell more food with a new source of income from their own kitchens.

“We’re kind of the opposite of a ghost kitchen,” Canter said. “There are a lot of terms floating around, but we’re not putting dark kitchens in new places. We’re turning regular restaurants into ghost kitchens.

The biggest changes brought by Nextbite relate to data analysis. The Nextbite team can now associate their portfolio of brands with new locations. For example, Wiz Khalifa’s Packed Bowl does best on or around college campuses, Canter said. His team can also monitor reviews to understand customer experience and changing tastes.

While there is clearly a wide range of operational strategies for shadow kitchens and virtual brands, every company we spoke with agreed that the bar has been raised and not all delivery-only companies or brands will be successful, simply because the market was oversaturated in 2020. The best virtual catering companies focus on quality and know what their customers want instead of trying flash-in-the-pan gimmicks.

“Gone are the days when you could just create a menu in five minutes and stick it on DoorDash and expect it to work fine,” Canter said. “In the beginning, people were creating so many of these virtual brands and expecting them to work because there weren’t so many options. The space quickly became very crowded and now a lot of things have to go right for a virtual brand to be successful.

Contact Joanna at [email protected]

Find her on Twitter: @JoannaFantozzi

Comments are closed.