Your Guide to SiteMinder Limited’s IPO (ASX: SDR)

The world’s leading hotel software-as-a-service (SaaS) platform SiteMinder Limited (ASX: SDR) is expected to start trading on Monday, November 8.

SiteMinder Raises $ 627 Million in Its initial public offering (IPO), valuing the company at $ 1.3 billion.

Let’s dive into the IPO and see why SiteMinder could be a great investment opportunity.

Bringing accommodation into the 21st century

Founded in 2006 by Mike Ford and Mike rogers, SiteMinder aimed to open every hotel and accommodation provider to e-commerce.

Typical SiteMinder customers – known as small and medium-sized businesses (SMEs) – include local bed and breakfasts, motels, lodges and vacation rentals.

No more pen and paper or spreadsheets to manage bookings, rates, availability and booking channels (Airbnb, Booking.com, Expedia, Agoda).

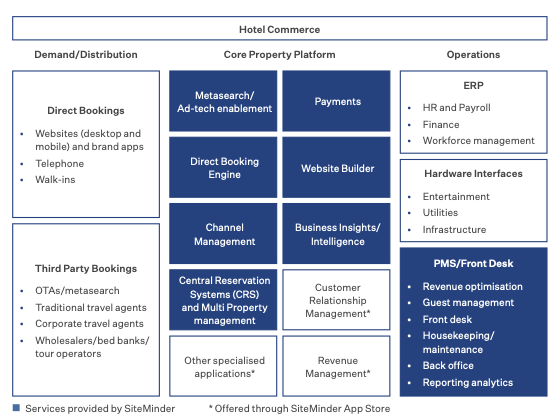

SiteMinder brings together all the administration under its channel manager. The platform is cloud-based, allowing hoteliers to run their business on the go.

“Our mission here at SiteMinder is to open up every web host’s access to e-commerce.”

Since then, the company has expanded its product line to include website builders, booking engines, and distribution with corporate agents.

SiteMinder connects over 425 hotel software systems with an equal number of distribution channels, delivering real added value to its customers.

The company operates 24/7 in 150 countries and has offices in Sydney, Bangkok, Manila, London, Galway, Berlin and Dallas.

The two founders remain involved in the company. Ford as non-executive director and Rogers as chief technology officer.

Critical software

When the pandemic hit, the travel industry literally came to a halt. Global hotel bookings have fallen by more than half, with travelers restricted to domestic travel.

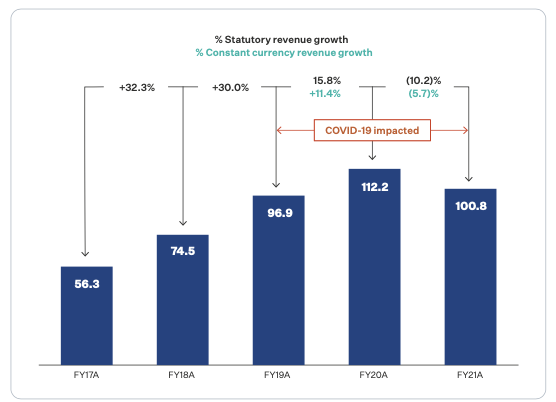

Despite this drop, SiteMinder’s revenue only fell from $ 112 million in FY20 to $ 100 million in FY21.

In fact, at constant exchange rates, sales only declined by 5.7%.

Why would SiteMinder’s revenue drop only 6% when its industry shut down?

SiteMinder is essential for its customers.

It is the last expense that is extinguished. Even if demand drops dramatically – as it did during the pandemic – customers still have to manage online reservations and guests.

Subsequently, the company was relatively less affected than the industry as a whole, demonstrating resilience and grip.

The opportunity

The global hotel market is estimated at over one million properties. SMEs represent 85% of this market, with a large part still using manual processes.

Currently, SiteMinder serves 32,000 properties worldwide, which suggests a market share of less than 4%.

As hoteliers digitize their operations – which will be more important than ever after the pandemic – SiteMinder should benefit from this structural change.

A team

It is worth highlighting the caliber of SiteMinder’s leadership.

Chairman and Chief Executive Officer and Chief Executive Officer, Sankar Narayan was once the Xero Limited (ASX: XRO) CFO and COO.

Product manager Inga Latham ranked # 7 in the 2021 Top Women Leaders in SaaS. In addition, the Marketing Director made the top 50 list.

President Pat O’Sullivan currently sits on the Board of Directors of Carsales.com Ltd (ASX: CAR), After payment Ltd. (ASX: APT) and TechnologyOne Ltd. (ASX: TNE).

Past employers and industry accolades don’t exactly correlate with success. But it provides a solid foundation.

Economy unit

83% of SiteMinder’s revenue is recurring subscription fees to its online platform. The remaining 17% comes from the transaction fees of subscriber properties.

Its gross margin hovers around 75%. Cost of sales is largely attributed to global customer support, account management, hosting services, and costs associated with transaction revenue.

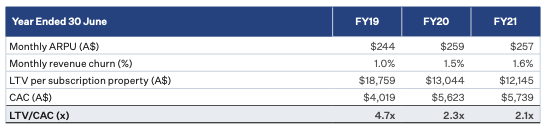

Before the pandemic, SiteMinder Lifetime value (LTV) at customer acquisition cost (CAC) was greater than 4.

However, the churn rate increased during the pandemic from 12% per year to 19%. In addition, fewer customers were onboarded due to a halving of demand.

Subsequently, the LTV / CAC fell to 2.1.

Despite the fall, management is confident it can return to historic levels once conditions normalize.

Evaluation

The IPO values SiteMinder at a market cap of around $ 1.3 billion. Its multiple enterprise value / income – a valuation ratio of SaaS companies – is 12.5.

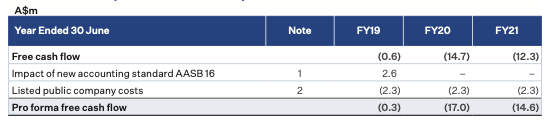

Despite collecting $ 100 million in revenue, SiteMinder is still not profitable on a EBITDA or on the basis of cash flow.

It lost $ 12.3 million in FY21, but nearly broke even in FY19 with a loss of $ 0.6 million.

Its biggest expense is sales and marketing, accounting for 35% of revenue in FY21.

The company will have $ 121 million in cash after the IPO, which, at the current rate of loss, should be enough for the company to achieve profitability without raising additional capital.

Why IPO now?

Of the $ 627 million raised, $ 537 million will go to selling shareholders and $ 90 million will be kept by SiteMinder for growth.

Business at risk TCV will pull out completely, selling its 22.4% stake, while the angel investor The Szekely and Ford will sell more than half of their holdings.

It seems to be net positive. Existing shareholders have the option of exiting through a public market while the company obtains better access to capital.

Competetion

SiteMinder is not alone in the hotel software market.

Various competitors exist. Some choose to focus on a single industry, such as channel managers, while others offer multiple options.

Clouds is arguably SiteMinder’s biggest competitor. SiteMinder and Cloudbeds compete for the top spots in the HotelTechAwards.

SiteMinder is characterized as an open platform. Subsequently, many of its competitors are also its partners.

Customers can mix and match whatever software suits them best, and SiteMinder can integrate seamlessly.

Trade update

The company did not provide a forecast for fiscal year 22.

However, it reported 10% revenue growth in the first quarter of FY22 compared to the previous fiscal year and an improvement in the fourth quarter of FY21.

My opinion

SiteMinder’s IPO certainly caught my eye.

The company provides essential service to its customers and, based on industry awards, is a leader in its software niche.

The management is top notch. The company has a long track for growth. And it will only benefit from the reopening of borders.

However, it is not without risks, mainly the competition and if SiteMinder can translate its growth into profitability.

I can’t wait to see how the business evolves on Monday. For now, Siteminder remains at the top of my watch list.

Comments are closed.