13F Analysis: Soros Fund Management (George Soros Fund) Q3 2022

Sean Gallup

In today’s article, we bring you the latest update in our recurring series based on analysis 13F deposits and the latest moves from some of the world’s most renowned funds. Our original article and main thesis on the subject is available via this link.

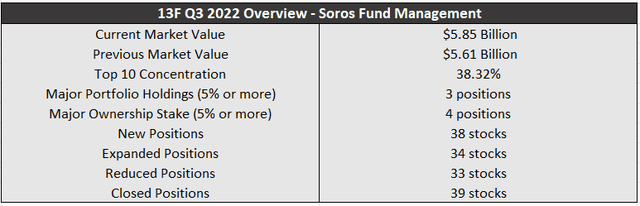

Fund Facts

Soros Q3 2022 Fund Snapshot (author’s spreadsheet)

Assets under management at U.S.-based Soros Fund Management rose to $5.85 billion from $5.61 billion reported last quarter, the first net increase after a few tough quarters. It is also a far cry from the high of $7.30 billion recorded in the fourth quarter of last year. The family office created 38 new positions during the quarter, many of which appear to be focused on ongoing arbitrage opportunities and “struggling” sectors such as the technology sector. The fund trimmed 33 positions while exiting its stake in 39 stocks. Soros Fund Management added 34 positions during the quarter, reinforcing a 38.2% concentration in the top ten funds. This is broadly in line with the comparison with last quarter when the fund concentrated 35.8% of assets under management in the top ten holdings. Only three companies make up 5% or more of Soros Fund Management’s portfolio, including Duke Realty and Biohaven Ltd. (BHVN), but are led by Rivian Automotive (SHORE) representing 9.19% of assets under management. Soros currently owns four major stakes taking 5% or more of Bowlero Corp. (BOWL), independent semiconductor (INDI), Proterra Inc. (ACWP), and TPB Acquisition Corp I (TPBA). Bowlero Corp remains arguably the largest holding as the fund owns over 27% of the company.

New positions

Energy sector SPDR put options (XLE): were the largest addition of the quarter and quickly rose to become the 15th largest stock in the portfolio. Soros likely acquired the put options in order to short the energy sector as 2023 approaches. XLE is currently trading at $84.43 per share and the put options represent 1.34% of the AT M.

ChemoCentryx Inc: was the second largest acquisition of the quarter and another merger arbitrage opportunity that has already played out, generating profits for the family office. The company was acquired by Amgen (AMGN) in late October in an all-cash deal worth $3.7 billion. Former CCXI shareholders received $52 per share for their stake in the company, with the stock trading between $25 and $52 per share in the third quarter.

Sierra Wireless, Inc. (SWIR): is yet another merger arbitrage play by Soros Fund Management, but active this time around. He is being acquired by Semtech (TCMS) in a $1.2 billion all-cash deal at $31 per share. The $31 acquisition price represents a 25% premium to SWIR’s closing price prior to the announcement of the transaction. Soros acquired a roughly 4% stake in the company throughout the third quarter, while the stock traded between $24 and $31 per share. However, SWIR is currently only trading at $29 per share.

Reservation credits (BKNG): represented the fourth largest acquisition of the quarter. The fund established a position that is now worth $17.74 million and represents 3.00% of the portfolio. They acquired 100,000 shares of the online booking giant during the third quarter as the stock traded between $1,670 and $2,150. However, it is only their 59th largest holding. BKNG is currently trading at around $1964 per share.

Soros Fund Third Quarter Heatmap (Quantitative Quiver)

Similarly, the fund established positions in companies such as Agree Realty (CDA), Sarepta Therapeutics (SRPT), Union Pacific (UNP), Vulcan Materials Company (VMC), Teledyne Technologies (JTD), AMETEK (SOUL), Zoom Video Communications (ZM), Cboe Global Markets, Inc. (CBOE), Fortive Corporation (FST), and others, as well as shorts through puts in Global Blood Therapeutics and Financial Select Sector SPDR (XLF).

Expanded positions

Real Estate Duke: Soros developed the DRE position once more before the merger arbitrage transaction actually closed last month. The $23 billion deal solidified Prologis (PLD) position as the largest industrial REIT. It was first acquired by the fund during the second quarter and grew to represent 5% of the portfolio before the transaction closed. Soros added 6.2 million shares, representing a 2,330% increase from shares held in the second quarter. The entire reported position is now worth $307 million.

Walt Disney (SAY): is one of the most held positions in the fund, the third largest position expanded during the quarter by percentage. Soros Fund Management first acquired the position in Q1 2020 and has since occasionally added to the existing position. The fund added 120,000 shares during the quarter, representing a 330% increase. DIS is still a relatively small position, being ranked 77th and accounting for only 0.20% of the AUM.

Selling power (RCMP): this is another quarter in which Soros Funds has strengthened its position in the popular cloud-based software company, which has been carefully built over the previous period. The fund continued to strengthen its position as it was hammered in the markets. It also increased by 7% this quarter. The position is now the 19th largest holding and is worth around $97.6 million. It currently trades at $153.35 per share and traded between $130 and $191 throughout the third quarter.

Spotify (PLACE): is a holding the fund first opened last quarter but expanded this quarter. Soros increased the position by 60% as the company traded between $86 and $123. The position is now worth $5.40 million and as such represents the 108th largest holding in the fund. SPOT is currently selling for $75.19 per share.

Other smaller positions that expanded during the second quarter were: Uber Technologies, Inc. (UBER), Las Vegas Sands Corp. (LVS), Airbnb, Inc. (ABNB), TransDigm Group Incorporated (TDG), Atlassian Corporation (CREW), Accenture plc (ACN), NIKE (NKE) and FIGS, Inc. (FIGS), among others.

Reduced positions

Rivian Automotive Inc: still holds the title of biggest bag the fund has held. Proving to be a highly problematic IPO, the fund continued to reduce its exposure to the electric vehicle maker by trimming the position by a further 8%. RIVN currently accounts for 9.17% of AUM. The fund entered the position during the fourth quarter of 2021, paying between $89 and $172 per share. Shares of the EV company are currently trading at around $28 per share.

DR Horton inc. (DHI): this was another quarter that saw the DHI position reduced, this time by a relatively large 12%. The fund sold 360,000 shares during the quarter, reducing the size of the position to 3.01% of the portfolio, from 3.51% in the previous quarter. DHI still represents the 5th largest holding as the fund holds 2.61 million shares worth $176.2 million.

Alphabet Inc. (GOOG): after expanding the position for a few quarters, the fund is pulling the breaks and reducing its exposure to Google by 4%. They sold 50,000 shares this quarter. Alphabet remains their 20th largest holding and occupies 1.66% of the portfolio. The company currently trades at $95 per share.

Freedom Broadband Corp (LBRDK): before being cut this quarter, the piece of John Malone’s media empire was their 3rd largest holding, occupying 3.60% of the portfolio. However, Soros Funds reduced the position by 20%, having sold 350,000 shares during the period. Today, it is only the 14th largest holding, occupying 1.66% of the portfolio. It is currently trading at $86 per share.

Other smaller positions that were reduced during the second quarter were: Sea Limited (SE), National Energy Services (RENS), Sports and Outdoors Academy (ASO), Piedmont Lithium Inc. (PLL), Analog Devices, Inc. (ADI), BGC Partners, Inc. (BGCP), LPL Financial Holdings Inc. (LPLA) and others.

Closed positions

US Campus Communities: formerly known as the ACC ticket, is another successful merger arbitrage. The fund took the position last quarter and sold it entirely as the merger was completed. The student housing developer was acquired by Blackstone (Bx) in a cash transaction with a value $12.8 billion. ACC shares were redeemed for $65.47 per share. The $201 million position represented 3.59% of the fund.

Other significant closed positions were also mostly successful merger arbitrages such as Meritor Inc which was acquired by Cummins (CMI), GCP Applied Technologies which was acquired by Saint-Gobain (OTCPK:CODGF), Turning Point Therapeutics which was acquired by Bristol Myers Squibb (BMY), and others.

You can see full filings for Soros funds and additional 13F filers here.

Final preview

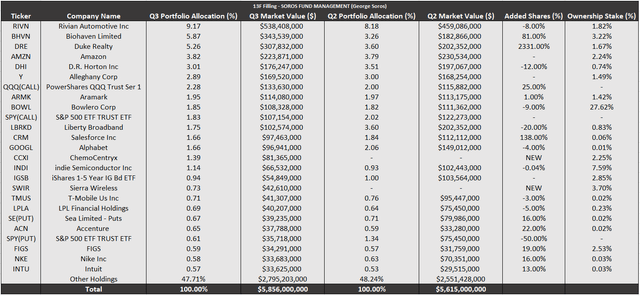

Soros Fund Holdings Q3 2022 (Data from author’s spreadsheet 13F)

The strategy deployed by Soros Fund Management seems to be based on two main principles. On the one hand, the fund acquires or increases its holdings in heavily dejected tech stocks, which slowly climb to become one of the portfolio’s top positions. On the other hand, the fund still seems to be continuing its efforts to find attractive merger arbitrage opportunities that are expected to provide stable returns in the face of a seemingly constantly deteriorating market environment.

Comments are closed.