FTX-Burnt Crypto Hedge Funds Seek Wall Street-Style Middlemen

(Bloomberg) — Prior to its collapse, FTX was a favorite in the world of professional crypto traders, with frenzied volumes, derivatives on steroids and a simpatico founder who got his start at the famed trading house of Wall Street, Jane Street.

Now that millions have been lost on the bankrupt platform, its former fans are fighting for survival, writing off significant chunks of their wallets, and facing an existential dilemma: should they trust a crypto exchange?

Unlike stock markets where every transaction is chained through a daisy chain of intermediaries, centralized crypto exchanges like Binance Holdings Ltd. do everything from margin lending and settlement to direct custody of client assets. This means that funds must entrust platforms with not only the assets they trade, but also the collateral they put in place as leverage to maximize returns.

For many traders who saw their holdings evaporate in a matter of days on FTX, this became too much demand. To avoid another disaster, some survivors began looking for alternatives to the current crypto markets infrastructure, taking a page from Wall Street’s rulebook and requiring separate entities, like custodians, to hold their crypto at the place.

“The era of posting collateral on offshore exchanges is over,” said David Fauchier, portfolio manager at Nickel Digital Asset Management, which oversees about $200 million and has a 6% partially insured exposure to FTX. “We refuse to post collateral directly on almost any site, which means we can’t trade there despite having a great opportunity, which is very frustrating. We hammer them every day to implement some form of off-exchange settlement solution.

Although there have long been calls for change, Fauchier says there may finally be some momentum, after FTX appears to have lost the majority of client assets in its custody, with the 50 largest unsecured creditors losing everything from $21 million to $226 million.

It’s an irony of the whole saga: While FTX founder Sam Bankman-Fried spent his final months as a billionaire trying to make the old-school futures market look more like crypto, he could end up making crypto look like Wall Street.

With the slogan “built by traders, for traders”, its platform has won over professionals with its easy lending and products ranging from triple-leveraged bets to tokenized Tesla shares. At its peak this year, it processed over $45 billion in a day, according to data from CoinGecko.

Today’s stock market crash dealt a major blow to much of the nascent crypto fund industry, including Kevin Zhou’s Galois Capital, Travis Kling’s Ikigai Asset Management, and CoinShares. CMS Holdings, which also invested in FTX, has about 15% of its assets frozen on the stock exchange, according to a person familiar with the matter who declined to be identified as the information is private.

Many crypto hedge funds are now considering negating exposure and setting aside, which means they will allocate illiquid assets to a separate share class that will receive all future distributions of debt. Some are considering selling the claim now, which will allow them to raise cash rather than hold on to a troubled asset through the meandering bankruptcy process – although the claims are now only valued at 9% to 11.5 % of their value, according to broker Cherokee Acquisition.

“It’s not killing the industry,” said George Zarya, managing director of crypto brokerage Bequant. “But it’s a punch below the waist and it really hurts.”

FTX’s collapse is the latest blow to an already difficult year. A Bloomberg index of crypto-hedge fund returns plunged 43% this year in October, as Bitcoin lost more than 60% and falling retail sentiment killed 2021’s easy trading opportunities.

Under the status quo, exchanges match buyers and sellers, protect assets, extend trade credit and also settle profits and losses, which requires them to directly see and access user collateral, according to the report. ‘argument. Critics say this has given exchanges inordinate power over client assets and created a concentration of risk.

While the shocking demise of FTX has prompted many exchanges to release proof of reserves, this still fails to reveal all of their liabilities, leading to users withdrawing millions from online platforms.

This structure is a far cry from what the crypto world calls TradFi, or traditional finance, where the role of intermediaries, from custodians to brokers and exchanges, is regulated and trades are settled on an independent centralized clearinghouse.

Some of these intermediaries exist in crypto, but few have been able to reduce the power of the exchanges. A solution offered by depositary Copper Technologies Ltd. allows clients to trade without transferring assets to the exchange’s wallets. But so far, none of the top five trading platforms ranked by Coinmarketcap is connected to it. FTX subscribed to this offer, but never implemented it, Copper says, adding that it plans to announce more exchange integrations in the coming months.

Wall Street is also turning to household names like BNY Mellon and Nasdaq, which are working on their own custody services.

“Asset managers and market makers are demanding the integration of the solution as they will no longer be able to attract investors regardless of the promised returns if they place assets on any exchange,” Fadi Aboualfa wrote. , head of research at Copper, in an email.

At Cumberland, the crypto offshoot of Chicago trading giant DRW, the OTC trading desk saw record volumes and an increase in onboarding requests this month as liquidity on the exchanges dwindled, said the Global Director Chris Zuehlke.

Wintermute, one of the biggest crypto market makers, has reduced “a lot” of exposure to centralized exchanges, according to founder Evgeny Gaevoy. Its ideal: either run entirely on decentralized exchanges or adopt a model closer to CME Group Inc., where trading and custody are separated.

The elephant in the room is Binance, by far the largest exchange that is grabbing even more market share from its disgraced rival. It unveiled its own custody solution that would allow clients to keep their assets in separate wallets while trading on the platform.

Still, institutions are unlikely to agree to voluntary separation within the same corporate group, said Larry Tabb, head of market structure research at Bloomberg Intelligence.

“Larger institutions will self-custody in their own wallets or seek third-party custodians to hold their coins,” he said. “This is going to significantly disrupt the current business model of some of these large crypto establishments.”

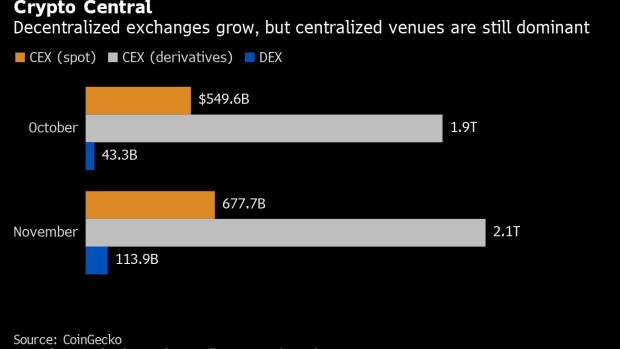

Then there is decentralized finance, the solution defended by those most faithful to the crypto vision. On platforms like Uniswap and dYdX, users trade through software while maintaining control of their assets. While volumes on the five largest Dexes more than doubled from October to $114 billion this month, this still represents only 4% of the total centralized platforms, according to data from CoinGecko. DeFi is also not practical at scale for many regulated businesses at this time, as it poses money laundering and other compliance risks.

“We trade on-chain when we can, but the liquidity isn’t where it is on Binance, so it’s tough when you have a little bit of size,” said Felix Dian, a former Morgan Stanley trader who now runs MVPQ Capital, a crypto hedge fund with 2% assets lost to FTX. “The way to go is to spread your exposure, although to be honest it’s difficult because there aren’t many counterparties left.”

©2022 Bloomberg LP

Comments are closed.