Home sales melt nationwide to depths of housing crash 1. Price -10% in 5 months. Cash Buyers and Investors Pull Out Massively

The seller-buyer standoff.

By Wolf Richter to WOLF STREET.

Sales of all types of second-hand homes, condos and co-ops fell 7.7% in November from October, the 10th straight month of declines, to a seasonally adjusted annual sales rate of 4.09 million. houses, almost matching the lockdown-low in May 2020. And beyond May 2020 was the lowest rate of sales since Housing Bust 1 began, November 2010, according to to data from the National Association of Realtors.

Year-over-year sales fell 35%, the 16th consecutive month of year-over-year declines. Compared to the recent free money peak of October 2020, sales are down 39% (historical data via Y-Charts):

The sales figures above are “seasonally adjusted annual rates” of sales, so what sales would look like for an entire year at the current rate of sales. Actual November sales, unadjusted, were 326,000 homes, also down 35% from November 2021 (503,000 homes).

Cash buyers pull back massively. Cash sales accounted for 26%, or about 85,000 homes, of the total 326,000 homes sold in November, based on actual sales and not the seasonally adjusted annual rate. This represented a 24% share in November 2021. But given the much higher number of home sales in November 2021 (503,000 sales), the 24% share of cash sales amounted to 120,000 cash sales .

In other words, the actual number of cash sales fell by 35,000 year-over-year, although the share of cash sales increased by 2 percentage points amid falling overall sales. .

Individual investors or buyers of second homes are also withdrawing massively. They bought 14% of all homes sold, or about 45,640 homes (actual annual rate, not seasonally adjusted), down nearly 30,000 homes from November 2021, when they bought 75,450 homes (for a share of 15%).

Cash buyers and investors are like everyone else: they too see what is happening in this housing market.

Sales of single-family homes plunged 7.6% in November from October, and 35% year-over-year, to a seasonally-adjusted annual rate of 3.65 million homes.

Sales of condos and cooperatives plunged 8.3% in November from October, and 37% year-over-year, to a seasonally adjusted annual rate of 440,000 units.

Sales fell in all regions, but dipped furthest west and south. Month to month and year to year:

- Northeast: -7.0% mom; -28.4% YoY.

- Midwest: -5.6% mom; -30.6% YoY.

- South: -7.1% mom; -35.0% YoY.

- West: -12.5% mom; -45.7% YoY.

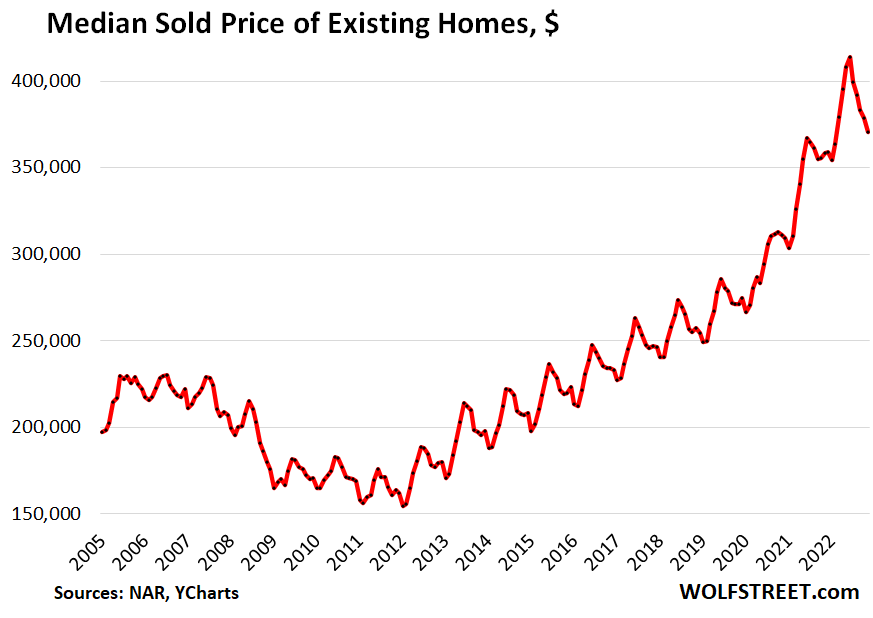

The median price of all home types whose sales closed in October fell for the fifth consecutive month to $370,700, down 10.4% from the June high. That decline reduced the year-over-year gain to just 3.5%, from a year-over-year gain of 15% a year ago.

Only part of this decline from June to November is seasonal. In the five years before the pandemic, the average drop from June to November was 5.8%, with a peak drop in 2015 of 6.9%. This shows that the current decline of 10.4% is well beyond even the maximum seasonal decline. This is also confirmed by the rapid decline in year-over-year price gain to just 3.5% (historical data via YCharts):

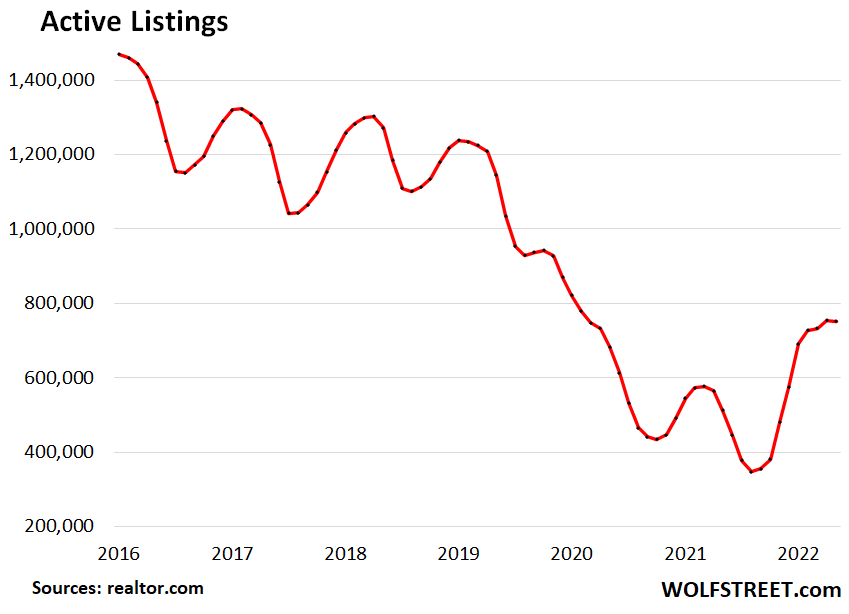

Active announcements (total inventory for sale minus properties awaiting sale) were roughly flat on the previous month, at 751,500 homes in November, but up 47% from a year ago and the highest since August 2020.

Active listings remain relatively low as many would-be sellers are praying for a magnificent pivot from the Fed that will bring mortgage rates down to 3% in no time, and they haven’t put their vacant home on the market because they always think that this too will pass; and if the house has been on the market for a while and hasn’t nibbled, they’ll take it off the market, especially during the holiday period (data via real estate agent.com).

Monthly supply in November was unchanged from October at 3.3 months, the two highest months since June 2020.

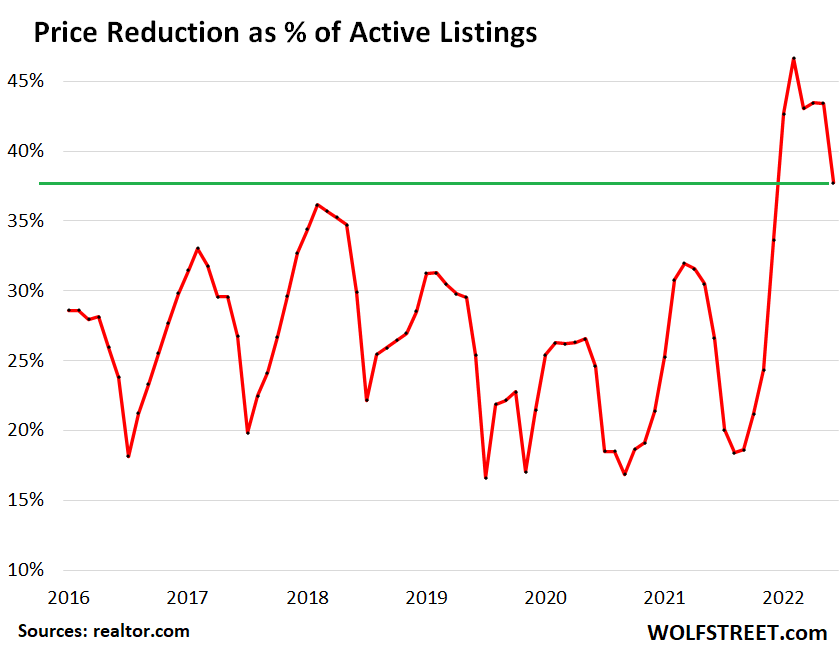

Price reductions: In November, 38% of active listings had price reductions. Although down from previous months, all of the past six months have seen a higher proportion of price cuts than any of the previous months in realtor.com data going back to 2016 (data via real estate agent.com).

Seller-buyer confrontation: This combination of plummeting sales, falling prices, rising but still tight supply and a very high proportion of price reductions when homes finally appear on the market indicates that there is a standoff between potential sellers, who think they will wait for the Fed’s inflation fight; and potential buyers who have no appetite for overpaying, even cash buyers are pulling out in droves, despite not being dependent on mortgage rates.

As always, homes that are priced right sell very well, but “right price” means the price is low where potential buyers are, and there are plenty of them, but they are several floors down. And as potential sellers find out, their homes will sell.

Do you like to read WOLF STREET and want to support it? You can donate. I greatly appreciate it. Click on the mug of beer and iced tea to find out how:

Would you like to be notified by e-mail when WOLF STREET publishes a new article? Register here.

![]()

Comments are closed.