Margin Watch: Here are some of the consumer companies holding their margins despite rising costs

In 2022, businesses faced serious levels of inflation for the first time in decades. The result for many companies has been lower gross margins and operating margins. But it was also an opportunity to see which companies were able to maintain their profit margins and which weren’t.

We looked at companies in the U.S. Consumer Discretionary sector to see which stood out in each industry. We compared Q3 21 margins with Q3 22, and looked specifically at gross margins (revenue – the cost of goods sold) and operating margins which reflect the effect of other operating expenses on profit net.

If a company can maintain or improve its margins in an inflationary environment, it may have pricing power, that is, the ability to raise prices without losing sales to competitors. This is a distinct competitive advantage. If a company cannot raise prices as costs rise, those costs translate into lower returns for shareholders.

Companies in each industry with better margins also have more cash to reinvest in the business, which can further improve their competitive position.

Clothing and specialty retailers

Most retailers have seen their margins decimated by rising costs over the past year. Interestingly, most companies with declining gross margins experienced an even greater decline in operating margins, implying negative operating leverage.

There were, however, a few notable exceptions – companies that managed to maintain or improve their gross and operating margins.

MercadoLibre (Nasdaq: MELI) and five below (Nasdaq: FIVE) improved both gross and operating margins. Home Depot (NYSE: HD) margins were both stable, which could probably be considered an advantage over the rest of the industry.

Among the losers were YETI Holdings (NYSE: YETI), DICK’S Sporting Goods (NYSE: DKS), Urban outfitters (Nasdaq: URBN), American Eagle Outfitters (NYSE: AEO). These companies all saw their gross margins fall by more than 10% while their operating margins fell by 16 to 52%.

Restaurants

Listed restaurants fared slightly better than retailers – but again the results were very mixed. Chipotle (New York Stock Exchange: CMG) managed to increase its gross margin by 3%, and its operating margin by 23%! Yum Brands (NYSE: YUM), McDonald’s (NYSE: MCD), and Texas Truck Stop (Nasdaq: TXRH) kept their margins more or less flat.

Margins for Dominos Pizza (NYSE: DPZ) and Wendy’s (Nasdaq: WEN) fell more or less in line with inflation. Cracker Barrel (Nasdaq: CBRL ) and Daddy Johns (Nasdaq: PZZA ) struggled to rein in rising costs and saw a sharp decline in operating margins.

Travel & Leisure

Casino and hotel groups Wynn Resorts (Nasdaq: WYNN) and Las Vegas Sands (NYSE: LVS) managed to increase gross margins as business normalized, but massive cost increases resulted in lower operating and net margins. Entertainment Caesars (Nasdaq: CZR) fares a little better.

Elsewhere in the travel industry, Avis Budget Group (Nasdaq: RCA) and Marriott Vacations Worldwide (NYSE: VAC) managed to maintain their margins.

Airbnb (Nasdaq: ABNB) and Expedia Group (Nasdaq: EXPE) managed to maintain their gross margins and improve their operating margins.

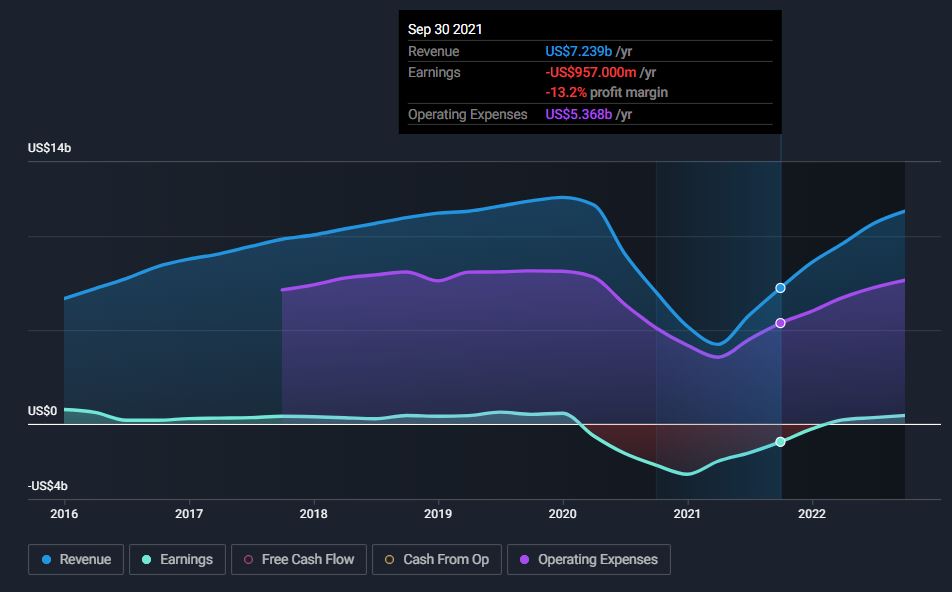

The companies hardest hit were Lyft (Nasdaq: LYFT) and UberTechnologies (NYSE: UBER) as they battled rising fuel prices and fierce competition.

Multimedia entertainment

Most media entertainment companies have seen a noticeable increase in expenses that has squeezed their operating margins. waltz disney (NYSE: DIS) was an exception – although that may have been the result of its parks returning to normal.

Nexstar Media Group (Nasdaq: NXST) and press company (Nasdaq: NWSA) also managed to maintain their gross margin and benefit from operating leverage.

The losers in the media were netflix (NasdaqGS: NFLX) and Roku (Nasdaq: ROKU), both of which have been squeezed as competition intensified.

Other consumer industries

In the automotive industry, Harley-Davidson (NYSE: PORK) stood out as a company that managed to substantially improve its margin. Ford (NYSE:F) was a notable loser in the industry, profitability taking a hit at every level of the income statement.

Among shoe brands, Nike (NYSE: NKE) was able to maintain its gross margin – which shows the power of its brand. United States (NYSE: SKX ) and Crocodile (Nasdaq: CROX) have both suffered from rising spending.

Residential construction was the only industry where almost all companies improved their margins. This may be due to the fact that the price of building materials rose at the beginning of the year and then fell. Taylor Morrison Home (NYSE: TMHC ) and Knowledge base home (NYSE: KBH) have both improved operating margins by more than 50%.

What this means for investors

The impact of rising costs on profit margins within each industry can show us which companies are better positioned and which are not. In this article, we have only considered changes in profit margins – obviously growth and value are also crucial.

Actual margin levels are also important. If a company’s net margin is improving, but it’s still only 2%, it’s still not very profitable.

For many companies in the sector, debt is also an element to consider.

To view the full analysis of any of the stocks listed above, along with any risk factors you want to be aware of, click on the hyperlink.

What are the risks and opportunities for Home deposit?

The Home Depot, Inc. operates as a home improvement retailer.

Awards

-

Earnings are expected to grow 3.47% annually

-

Revenue increased by 7.3% over the past year

Risks

-

Significant insider selling in the last 3 months

-

Has a high level of debt

Feedback on this article? Concerned about content? Enter into a contract with us directly. You can also email the editorial [email protected]

Simply Wall St analyst Richard Bowman and Simply Wall St have no position at any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. Our goal is to bring you targeted long-term analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative materials.

Comments are closed.