The InPost list offers a gift of 2.8 billion euros for Advent

Retail and Consumer Industry Updates

Sign up for myFT Daily Digest to be the first to know about retail and consumer industry news.

For four years of work, it was not a bad result. In 2017, Advent acquired the Polish parcel locker operator InPost and its main shareholder Integer as part of transactions valuing the couple’s equity at 430 million zlotys (102 million euros).

The private equity group and two smaller co-investors on Wednesday sold 35% of InPost for € 2.8 billion as it debuted in Amsterdam in Europe’s largest listing so far This year.

The sale is the latest sign of investors’ thirst for e-commerce stocks as the pandemic drives an ever-increasing share of online shopping.

Before the deal was even priced, three big investors – BlackRock, Capital World Investors and Singapore’s GIC – pledged to buy 1.03 billion euros in shares. On Monday, InPost shortened the offer period and brought the listing forward by two days due to what it called “significant investor demand”.

But in addition to looking for bright spots in the pandemic-stricken economy, investors who pushed InPost’s market capitalization 15% to 9.2 billion euros on day one of trading are betting more. long term that this can disrupt the way online purchases end up with customers after the loosening of closings.

At present, the delivery of these goods is heavily dependent on courier services. InPost offers an alternative: a network of automated lockers – what the company calls automatic parcel dispensers (APMs) – scattered around towns and villages where customers can pick up their purchases more or less at their convenience, rather than waiting. the arrival of a courier.

In Poland, 49% of the population already live within a 7-minute walk of one of InPost’s lockers and its app has 5.6 million users. The group now plans to extend its model elsewhere in Europe.

“In five to seven years, I have a feeling that door-to-door deliveries will be 40% of the market or less,” said Rafal Brzoska, CEO and founder of InPost, which retains a 12% stake in the business. He argued that the remaining 60 percent – the “current, old-fashioned setup” of people collecting in stores or post offices – “needs to be automated and will be automated with APMs.”

The group’s objective is to conquer at least half of the total market in Poland. “It will be a long journey to have a large share of the out-of-home market in other geographies[but]our ambition is always to achieve the best model that we have created in Poland, ”he said.

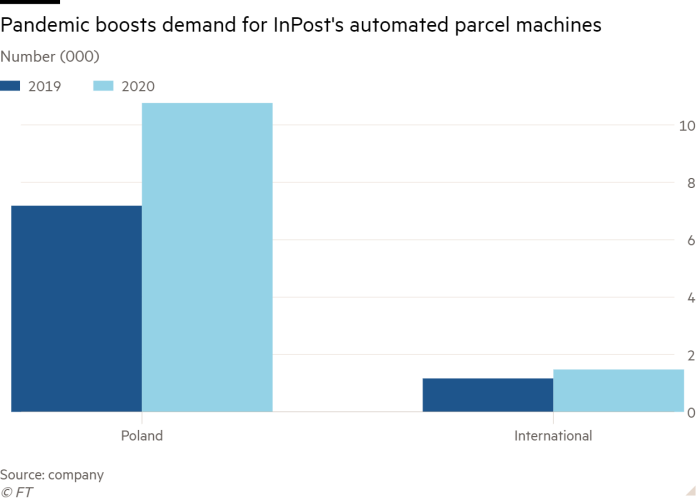

InPost’s position in Poland has grown considerably under Advent, which will retain at least 40 percent of the company’s capital. Since 2017, its APM network in Poland has more than quadrupled to 10,776 and it plans to deploy up to 5,000 more this year.

Net profit increased sharply during the pandemic, from 50.8 million zlotys (11.2 million euros) in 2019 to 208.7 million zlotys (45.9 million euros) in the first nine month of 2020.

One of the main challenges will now be to diversify its activity, both in Switzerland and abroad. In the first nine months of 2020, 99.4% of InPost’s revenue came from Poland. Almost half came from sales through Allegro, the dominant Polish e-commerce site, which last year became the country’s largest listed company after it was launched on the Warsaw Stock Exchange in the country’s largest IPO. country.

“There is a high concentration of income,” said Konrad Ksiezopolski, head of EEC equity research at Haitong Bank in Warsaw. “The brutal truth is that Allegro dominates the Polish e-commerce market, so the revenue structure… Comes from the market structure.

Adam Aleksandrowicz, chief financial officer of InPost, said the high share of sales coming from Allegro goes both ways, noting that 70 percent of Allegro’s “last mile” volumes were delivered via InPost. “You could turn the question around and say, how much is Allegro dependent on us?” ” he said.

Nevertheless, in order to cover the risks associated with having a single large customer, InPost signed an agreement with Allegro last year which commits the e-commerce site to provide InPost with a minimum parcel volume for at least four and a half years. It has also sought links with other ecommerce groups and plans to start offering products sold through Amazon later this year.

Expansion abroad will bring greater diversification. Mr Brzoska said InPost will add 2,000 APMs to the UK this year – currently its main overseas market – to almost triple its network there.

The group also intends to expand into Italy, France and Spain, three of the largest European e-commerce markets, which it described as “almost white space” and thus offered favorable conditions for the entry of InPost.

Even though it is expanding abroad, InPost faces greater challenges in its own territory. Amazon announced on Wednesday that it will launch a Polish website and speculation is rife that it and other e-commerce groups, such as Allegro, AliExpress and the Poczta Polska postal group, could set up their own locker networks. .

“Currently, none of these players is a threat to InPost. The problem for the company will be when the combined infrastructure of competitors starts to match that created by InPost, ”said Karol Tokarczyk, digital economy analyst at Polityka Insight in Warsaw. “[Then] the quality of service and the pace of parcel delivery will also be important.

Despite the resources that groups like Amazon could mobilize, Mr. Brzoska insisted that the entry of the American giant into the Polish market should not cause trouble for InPost.

“Once [Amazon] start promoting their own CPAs, advocacy for CPAs will increase massively, ”he said. “[And] the rest of the market, the market unrelated to Amazon, will start looking for an agnostic solution: and here we are.

Comments are closed.