a16z marks the first investment in India; More soon

a16z has made over 150 exits from companies such as Airbnb, Asana, Slack, Facebook, Instagram, Skype, among others and its current portfolio as lead investor includes over 250 startups, only one of which is Indian.

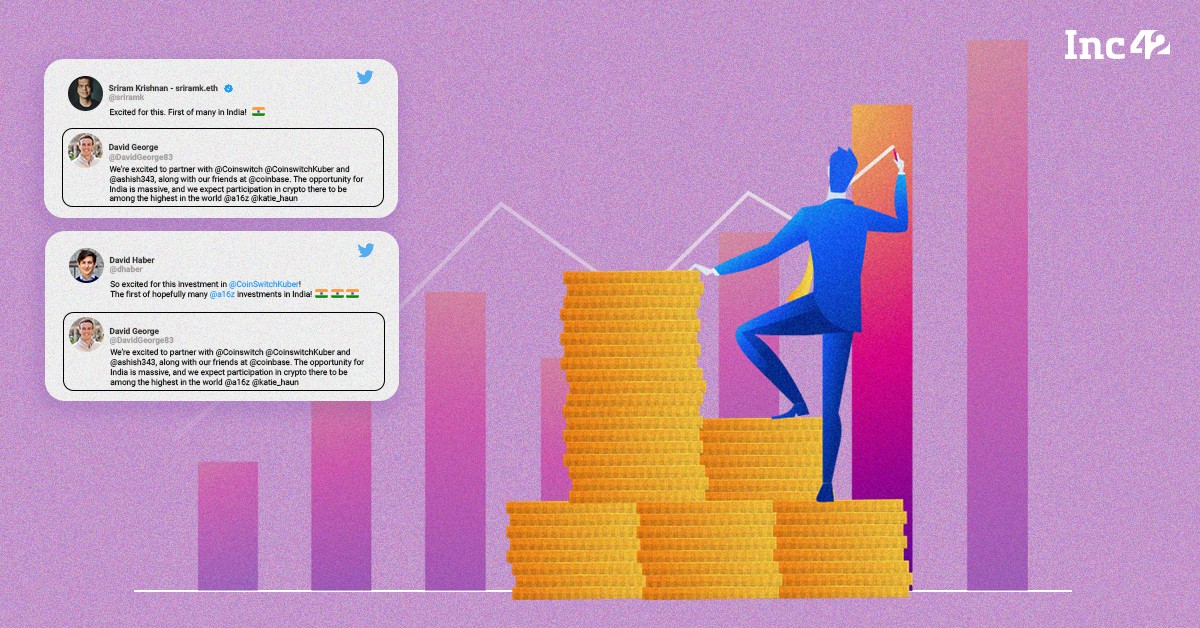

Two of a16z’s general partners tweeted that supporting CoinSwitch Kuber is the “first of many investments in India”

a16z reportedly evaluated a handful of other startups in India in recent months to invest beyond crypto

With an infusion of $ 260 million for a valuation of $ 1.9 billion, Andreessen Horowitz aka a16z made his very first bet in India in CoinSwitch Kuber – a crypto exchange startup, with both its funds from crypto and growth.

Co-led by Coinbase Ventures and with participation from existing investors Paradigm, Ribbit Capital, Sequoia Capital India and Tiger Global, CoinSwitch became the second Indian crypto unicorn after CoinDCX, backed by Coinbase.

It is the first of many a16z investments in India, according to sources and several media reports. In addition, two of the general partners of a16z have tweeted that supporting CoinSwitch Kuber is the “first of many investments in India”.

US-based A16z is one of the largest venture capital (VC) funds in the world with more than $ 19.2 billion in assets under management (AUM) spread across multiple funds. This includes its crypto funds of around $ 3.1 billion.

Coinbase Ventures, an investment arm of the US-based crypto exchange Coinbase, which invests in early-stage cryptocurrency and blockchain startups, was also supported by a16z. The venture capitalist pulled out of the company after its initial public offering on NASDAQ in April 2021.

a16z has made over 150 outings from companies such as hotel company Airbnb, workflow management platforms Asana and Slack, Facebook as well as Facebook-owned Instagram, ridesharing platform Lyft, fintech TransferWise , Microsoft-owned GitHub, and Skype, among others.

The current portfolio of the industry agnostic venture capital firm and stage of 250+ startups in which he is the lead investor includes, foodtech Gobble, workplace automation IFTTT (If This, Then That) , mediatech Buzzfeed, healthtech Bayesian Health Inc, edtech AltSchool, Fivetran data integration platform, among others.

a16z First investment; More soon

“We are incredibly excited about the opportunity for the crypto market in India, and with its exceptional growth, CoinSwitch has become the country’s leading retail platform,” said David George, general partner at Andreessen Horowitz. “Ashish and the team [of CoinSwitch] have demonstrated strong execution capabilities and ambition to provide an investment platform for the masses in India. “

The Indian cryptocurrency market was ranked 11th out of 154 countries in terms of crypto adoption and 6th in terms of DeFi (decentralized finance) by the Blockchain data platform Chainalysis, dropping from less than 1 billion dollars in April 2020 to over $ 6 billion in May 2021.

Still, the Indian crypto market is very volatile with a regulatory infrastructure in the works.

On the other hand, sectors such as e-commerce, fintech, edtech, healthcare technology and SaaS are high growth opportunities in the emerging Indian market.

A16z’s first Indian investment comes at a time when India is ranked second in the world in terms of internet users and internet companies are raising record capital.

According to an Inc42 Plus report, in the third quarter of 2021 (Q3 2021), Indian startups raised more than $ 17.1 billion, which is comfortably the highest amount raised in any given quarter in India since. that we started recording deals in 2014. Additionally, the startup ecosystem has seen roughly $ 28 billion invested over the past nine months.

To date, 72 Indian startups have joined the unicorn club, 30 of which joined the $ 1 billion + valuation club in 2021. Additionally, Indian startups are increasingly taking the public road, indicating that India is a fast growing geography.

According to a few sources and media reports, a16z has evaluated a handful of other startups in India in recent months to invest beyond crypto. Meanwhile, David Haber, general partner of Andreessen Horowitz, took to Twitter to comment on the investment in CoinSwitch Kuber, noting that it was “the first of many, hopefully a16z investments. in India “.

Sriram Krishnan, also general partner at a16z, confirmed the entry of the world’s largest venture capital firm in India, saying: “Excited by this [investment in CoinSwith Kuber]. The first of many in India! “

A16z will join several other global investors supporting the history of Indian startups. Tiger Global, Sequoia, Falcon Edge Capital, Temasek and SoftBank – which have stepped up the pace of their investments in the country in recent quarters.

Interestingly, Tiger is an investor in 30 Indian unicorns, including CoinSwitch Kuber. Likewise, SoftBank is an investor in 19 Unicorns.

Comments are closed.