Demand for short-term rentals in Europe returns to high levels, according to AirDNA

Demand for European short-term rentals is returning to high levels, despite challenges from the ongoing coronavirus (Covid-19) pandemic, a recent analysis by AirDNA find.

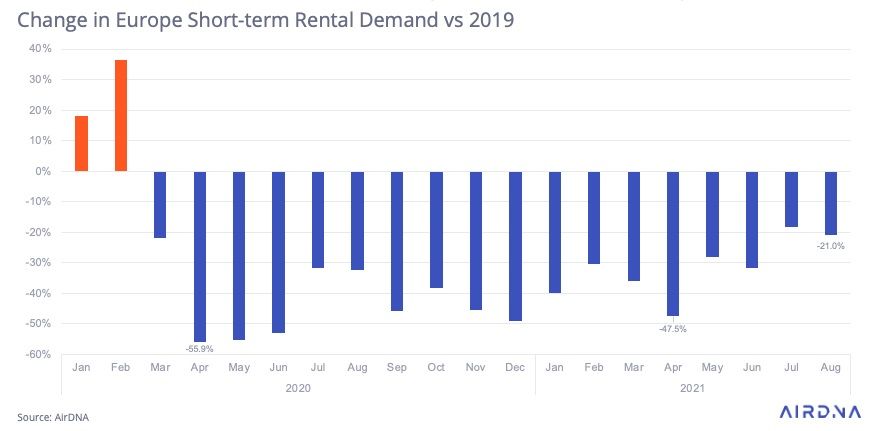

The company followed more than 42.3 million overnight stays sold in August 2021, which was the highest number of registration nights sold since the start of the pandemic.

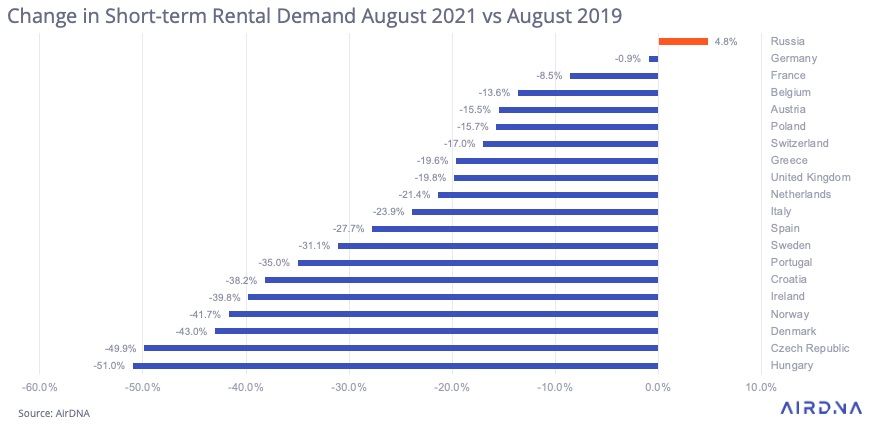

Still, it was 21% below 2019 levels, but 16.5% more than in August 2020.

“The decrease is a significant improvement over the loss of 45.5% recorded in April 2021,” AirDNA said.

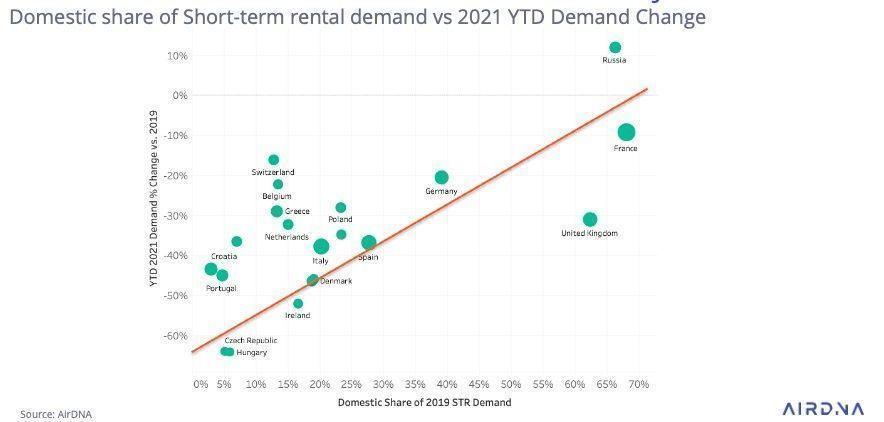

Domestic tourism, the engine of the recovery

The above graphic shows the share of each European country in the demand for short-term rental which was domestic, that is to say a stay in France by a French person, compared to the resumption of demand since the beginning of the year in this country.

Countries like Russia, France, and the UK all generated more than 50% of their short-term rental demand from domestic travelers and performed relatively well in the first half of 2021.

On the other hand, cross-border traffic accounted for over 90% of total demand in Portugal, Hungary and the Czech Republic and these countries struggled to generate demand levels close to the demand levels they saw in 2019.

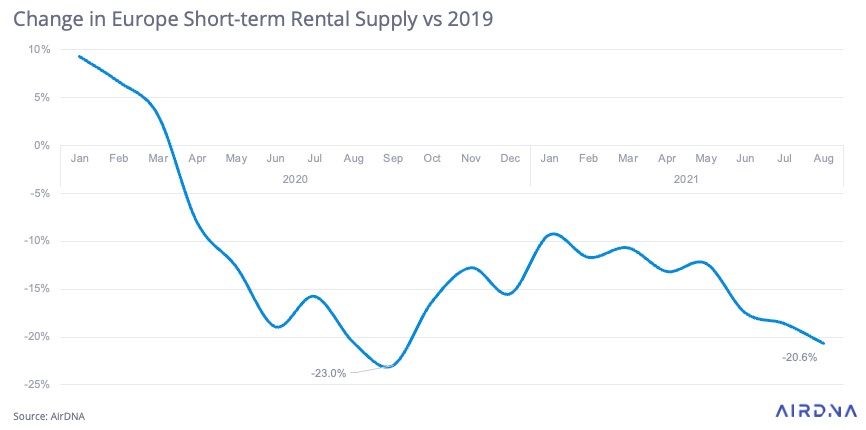

Loss of supply after low demand

Low demand is strongly correlated with listings leaving the market as landlords choose not to offer their properties for rent, even during the traditional high season. In August, Europe had lost up to 20% of its active registrations on Airbnb and / or Vrbo compared to the same period in 2019.

The total number of ads available in Europe reached 2.7 million in August, roughly the same level as in 2020.

The loss of registrations was mainly concentrated in the largest European cities. Of the 20 largest cities in Europe for short-term rental, five cities lost more than 50 percent of their available supply, including Prague (-58%), Edinburgh (-56%), Budapest (-55%), Amsterdam (-55%) and Moscow (-53 percent).

Saint PETERSBOURG (-14%) retained the highest percentage of its supply to major cities, largely due to high levels of demand in Russia throughout the recovery period.

Occupancy rate hits records

Lack of supply and high demand in many destination markets resulted in high occupancy rates as little supply was quickly reserved there.

This has led short-term rental occupancy in Europe to a all-time high of 73.6% in August 2021. This was 6.1% more than in 2019 and 13.6% more than in 2020. Six of the 20 largest countries in Europe achieved an occupancy rate above 75%, including Germany (79.1%), Croatia (79.1%), Netherlands (77.6%), UK (75.7%), France (75.4 percent) and Portugal (75.3 percent).

The average daily rate (ADR) that a customer paid for a short-term rental in August 2021 rose to 15.5% higher than in August 2019 and 9.2% higher than in August 2020.

The strongest growth of ADR was recorded in the UK (+ 32.6%) while the lowest gains were recorded in Russia at 5.6 percent.

Autumn / winter outlook

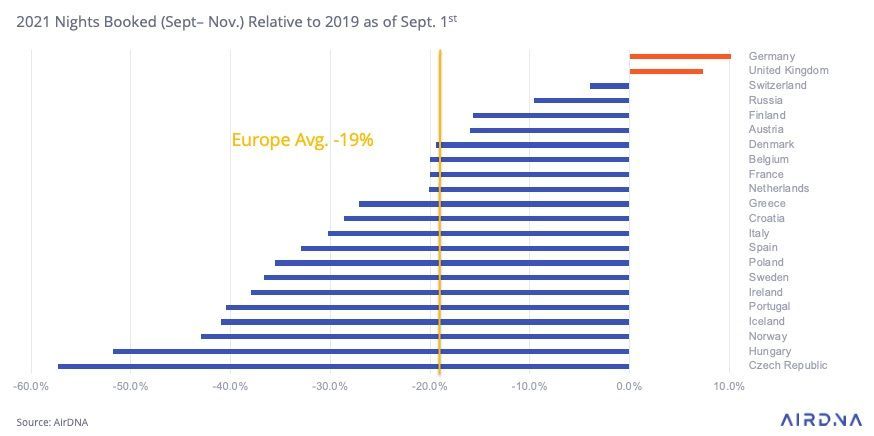

While the request for short-term rental booked, from September, for stays in September – November is still around 19% lower than the same point in 2019, it is significantly better than in 2020 and trending in a positive direction.

With new cases of Covid-19 falling and non-urban domestic demand continuing into the fall shoulder season, demand for Germany and the UK is expected to exceed 2019 levels in the coming months.

To follow GTP titles on Google News to keep up to date with all the latest news on tourism and travel in Greece.

Comments are closed.