Did Airbnb over-earn in 2021?

mammuth/E+ via Getty Images

Hard times ahead

Airbnb (NASDAQ: ABNB) pioneered the online short-term rental market and became the last name in space. Although the company itself is in a great position, with good management and good cost discipline, I think the company has gained too much and many tailwinds from last year are now becoming a headwind. Free cash flow has exploded over the last year leading to lower valuation multiples but multiples only get you so far what matters is the future performance of the business and I doubt that in the short term, performance is sustainable for Airbnb.

TAM

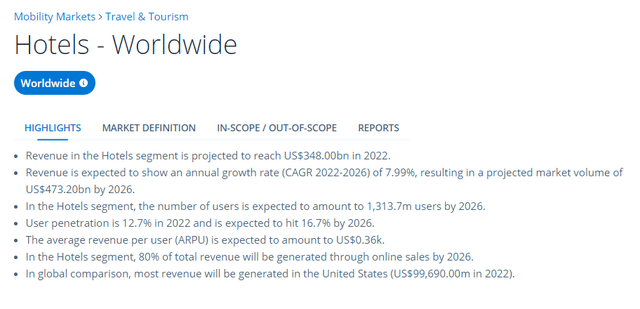

Airbnb estimated its total addressable market (“TAM”) at a whopping $3.4 trillion, made up of $1.8 billion in short stays, $210 billion in long stays, and 1. 4 billion dollars worth of experiences. It seems quite excessive if you look at forecasts from Statista regarding the global hotel market: we can see that in 2022 the market is expected to reach $348 billion and to reach $473 billion CAGR of 8% in 2026. I don’t understand where this huge market is expected to come from $1.5 trillion in addition to hotels. . Regardless of the exact numbers, there are plenty of growth avenues available for Airbnb, I just don’t like companies using these overly inflated TAM estimates.

Hotels – World statistics (Statist)

Great European Exhibition

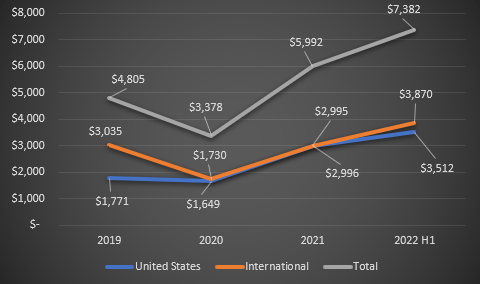

Airbnb only discloses revenue from two regions: US and International. We can see that since 2020 the two segments are roughly equal in size, with international taking the lead in the first half of 2022.

Airbnb revenue by segment (authors’ model, Airbnb 10k)

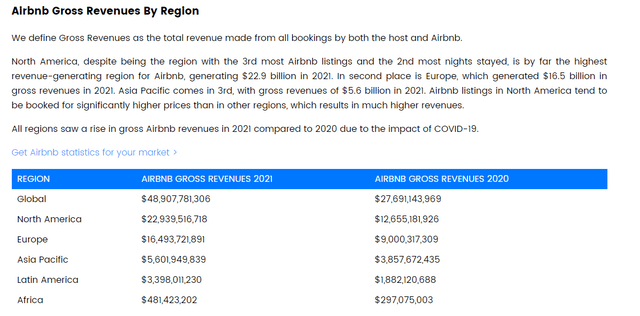

The aggregated international segment needs further investigation, for this we will look at data from All bedrooms, a data analytics company for short rentals. AllTheRooms uses gross revenue, which includes revenue from hosts and Airbnb. We can see that Europe accounts for 1/3 of Airbnb’s gross revenue and probably its total revenue as well, up slightly by around 1% from 2020.

Airbnb gross revenue by region (all bedrooms)

European energy crisis

According to ABC NEWS, the euro zone is experiencing unprecedented inflation since the introduction of the euro. 19 countries reported inflation above 10%, energy being the main contributor with an increase of 40.8% year-on-year! Food, alcohol and tobacco also pushed inflation to 11.8%. These are not signs of good discretionary spending for the Eurozone. Over the past year, we have seen strong pent-up demand from people who have been locked down for over a year without the ability to travel and go on vacation. This pent-up demand won’t last forever and by this point most people have probably already taken a vacation.

When I’m talking to fellow Europeans right now, the topic of conversation is much more likely to sound like “We’ve turned the heat down again because we can’t afford to heat the kitchen anymore” than “Have you booked your tickets for our holidays in Paris again?

Bookings from EMEA have been declining in recent quarters from 20% growth in Q1 to 11% growth in Q2 and I expect it to turn negative in the rest of the year due to these headwinds, at least for new bookings.

Withdraw from the Chinese market

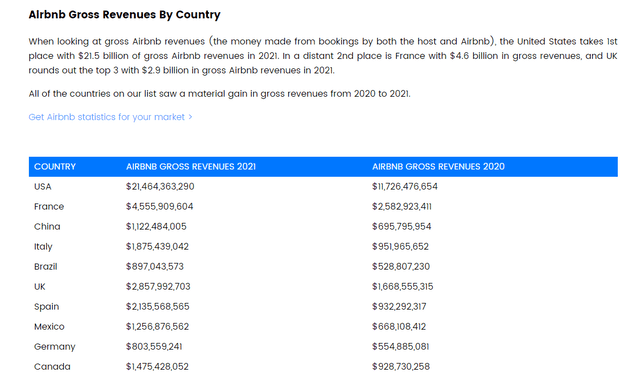

In May, Airbnb announced that it would close its operations in China. In the long term, it’s a good move, but in the short term, it will add another tailwind to revenue amid slowing business growth. China generated approximately 2.3% of Airbnb’s gross revenue in 2021 and is a difficult market for international businesses to enter. Domestic companies like Meituan have it easier in China. A comment from a recent 10K fill:

We will continue to incur significant expenditures to operate our business in China, and we may never achieve profitability or significant supply penetration in this market.

Few things to note: this only concerns the Chinese domestic market, with the biggest opportunity being international travel by Chinese tourists, which remains a long-term opportunity for Airbnb. Currently, the Chinese are experiencing widespread lockdowns due to their “Zero Covid” policy. It also limits Chinese international travel, another short-term headwind.

Airbnb gross revenue by country (All bedrooms)

Does Airbnb overpay?

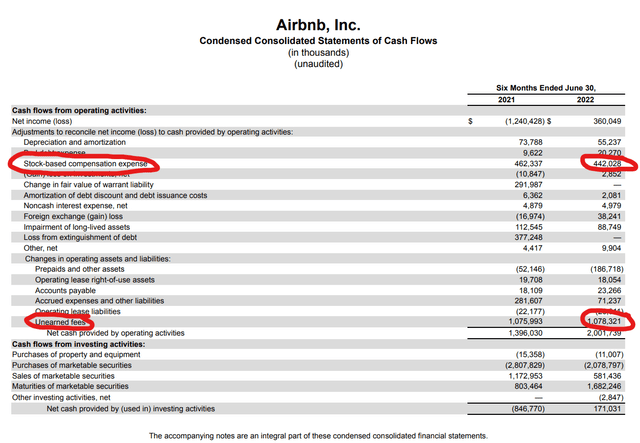

Airbnb is a high-margin business, being an online marketplace with high gross margins (81%) and without the need for expensive capital expenditures. The company managed to generate $2.77 billion in free cash flow (“FCF”) with a margin of 37% FCF. This extremely high FCF margin raises the question of whether this is sustainable or not. If we take a look at the cash flow statement, we can see that Airbnb was actually profitable under GAAP in the six months ending June 30 of $360 million. , compared to a loss of $1.2 billion the previous year. This was mainly achieved by much slower expense growth than revenue, the only costs that saw significant increases were sales and marketing and the cost of revenue was in line with revenue growth. FCF is significantly higher at $2 billion, a difference of $1.64 billion. We can see that the majority of this difference ($1.5 billion) comes from stock-based compensation (SBC) and unearned fees. Personally, I’m not a proponent of including SBC in FCF because even though it’s not a cash expense, it’s still an expense for shareholders, as they get diluted. Unearned fees are deferred revenue, where a guest books a stay and pays for a portion of it in advance. These unearned fees are recognized as revenue once the guest actually stays at the Airbnb. Total unpaid unearned fees on the balance sheet are $1.98 billion, the majority of the $2.77 billion in FCF over the last 12 months. These unearned fees benefited enormously from last year’s pent-up demand and I believe that in this recessionary environment, revenue growth will decline further. In the last quarter, forecasts amounted to 25% expected growth, which is significantly lower than the 60-70% growth rates of recent years. With Europe (1/3 of revenue) in deep crisis and the cost of living rising all over the world, I don’t see significant growth for Airbnb in the short term.

Airbnb cash flow statement (Airbnb 10Q)

Regulatory risks

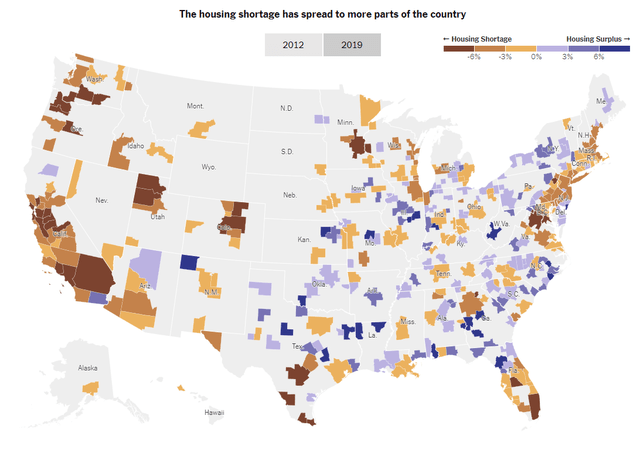

Another key risk is regulation. If we examine a map of the Shortage and surplus of housing in the United States we can see that the most densely populated places have shortages of 6% and more. Airbnb and other short-term rentals are ramping up this shortage by occupying space for rentals that could be used for a family. This opens up the risks for many regulations like these. already present in many cities around the world. Especially in a cost of living crisis with gas prices at record highs, I see this as a considerable risk to revenue growth.

United States Housing Shortage Map (New York Times)

Evaluation

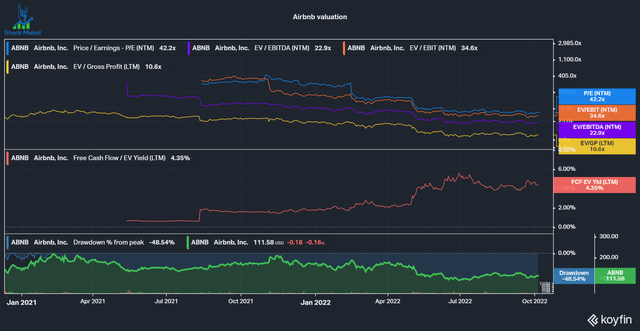

If we look at Airbnb’s valuation multiples, we can see that FCF’s yield has skyrocketed with the sharp rise in FCF, driven by unearned fees. At these levels, it would seem like a good deal, but as I mentioned earlier in this article, I’m not convinced that these FCF levels are sustainable. At the PE and EV/EBITDA level, we can see that the company is still high at 42 PE and 23 times EBITDA.

Airbnb Rating (Kofin)

Risks for my thesis

My short-term sell thesis revolves around Airbnb’s underperformance over its next few quarters, with free cash flow growth flattening or even declining due to last year’s over-earnings. . If the consumer, especially in Europe, proves stronger than I expect, then Airbnb may continue to raise prices. Chinese lockdowns are also a headwind at the moment, but if the government decides to lift the restrictions, we could see strong pent-up demand from Chinese citizens who now want to travel again.

Of course, we also have the risk of a sudden change in Fed policy, sending the entire market and with it, Airbnb higher.

Short term bearish, long term bullish

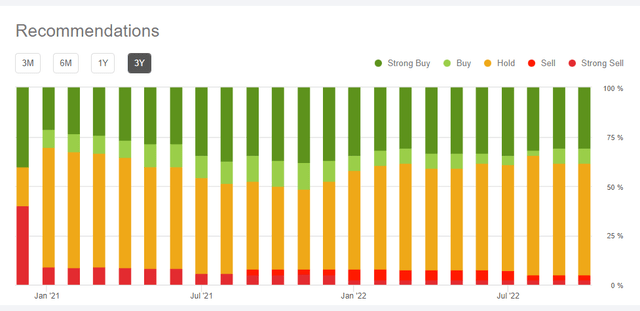

Analysts are still largely positive on Airbnb with an average rating of 3.61 (Buy) and an average price target of $138.59, I’m not as bullish in the near term and see the stock price falling back under $100.

Analyst recommendations for ABNB (Looking for Alpha)

Although Airbnb is seeing a significant 48% drop from ATH, I think the stock needs to drop further as previous tailwinds become potential headwinds in the near future. Let’s be clear, in the long term I like the Airbnb business. They created a new niche, launched it and became the household name. At these levels, I’m not a fan of the stock, but will consider the stock if we see further correction and execution remains strong. The company has shown great scalability over the past year with significantly increasing margins, driven by slowly growing operating expenses, it will be interesting to see how they fare if business slows.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Contrarian Investment competition which runs until October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not to be missed. Click here at learn more and submit your article today!

Comments are closed.