Engineers complain about prices, delays • The Register

The global shortage of semiconductors is forcing engineers to scramble to acquire spare parts, cancel projects or redesign hardware from scratch, distributor Avnet revealed this month.

Based on interviews with 530 engineers around the world, Avnet noted 93% of respondents see delays in chip deliveries, with longer lead times. A majority also expect chip prices to rise over the next 18 months.

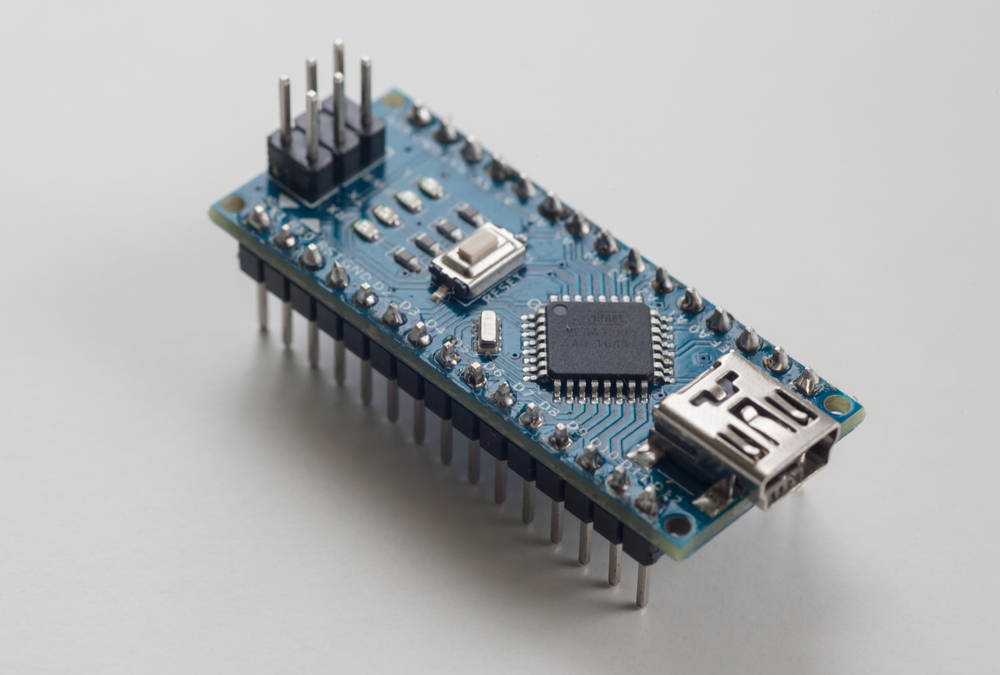

Among the most problematic parts are microcontrollers (MCUs), with delays spanning 50 weeks. Demand for MCUs has also exceeded supply, leading to drastic price increases. Respondents said MCU prices were “more than 10 and even 20 times higher than before the pandemic,” according to the survey.

Microcontrollers from companies such as STMicroelectronics and Texas Instruments have been in high demand. A popular STMicro microcontroller, the STM32F437VIT6, is enabled deferred order at Digi-Key, and has a 65 week delay on Mouser, while distributor Newark hopes restock on the microcontroller in April Next year.

During earnings call in January, STMicro CEO Jean-Marc Chery noted that price increases for its chips had helped generate more revenue, but the cost of producing those chips had also risen. Chipmakers have noted that a shortage of raw materials has increased the cost of manufacturing.

A US Commerce Department survey in January also identified the microcontroller shortage as hitting critical industries by disrupting the development of medical devices, broadband equipment and automobiles. The shortage was mainly for microcontrollers fabricated on legacy 40nm to 250nm nodes.

The chip shortage has also shut down car production lines – with some automakers releasing cars without premium features due to lack of chips. For example, GM removed features like auto start/stop because it can’t get the chips it needs.

Avnet’s survey found that 55% of engineers were redesigning boards or hardware due to chip shortages and rising prices. Engineers also had to delay board development or incorporate a new design that used widely available alternate components.

Of those surveyed, 53% were considering widely available parts and 35% were considering parts with fewer features and lower specs.

“The use of aftermarket parts also impacts the final product, with 81% of respondents reporting the need to modify the performance and functionality of the final product,” the survey says.

The United States and Europe have also raised alarm bells over counterfeit chips, which were also mentioned as a concern in Avnet’s report. About a third of respondents said counterfeit components would become a bigger problem, and 42% of respondents were testing and qualifying chips using X-ray detection or through third parties. ®

Comments are closed.