North Texas family loses home after builder pulls out without warning

Canceled for convenience: North Texas family loses home after builder pulls out without warning

A North Texas family says they have a warning for anyone buying a home from a builder. Just days before their home was closed forever, their builder backtracked. It turns out that the builder’s contract they were required to sign left them with virtually no protection.

OAK LEAF, Texas – A North Texas family says they have a warning for anyone buying a home from a builder.

Just days before their home was closed forever, their builder backtracked. It turns out that the builder’s contract they were required to sign left them with virtually no protection.

Tracey and Donnell Brundage were days away from moving into their forever home in Oak Leaf, Texas. They had booked movers and even bought a refrigerator for the kitchen.

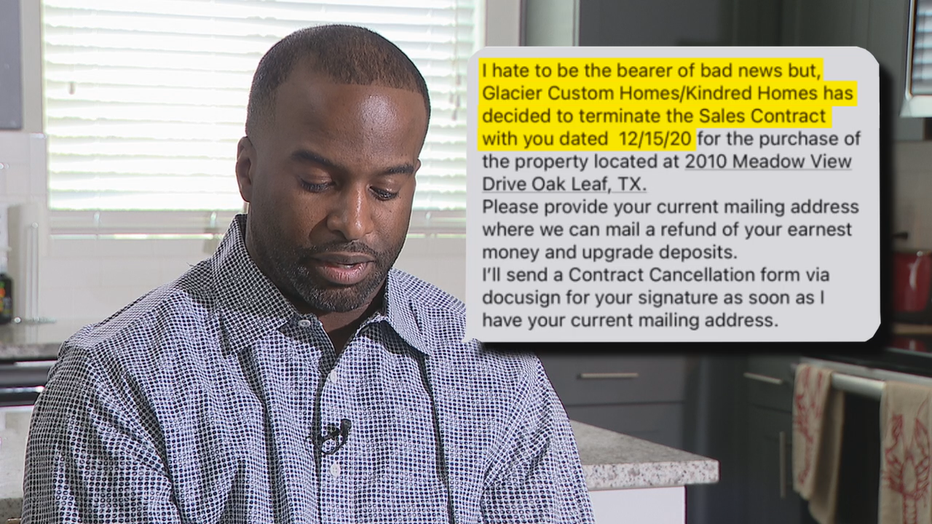

But six days before closing, after the couple had spent 16 months on construction, managed months of supply chain delays and spent thousands of dollars on escrow and upgrades, one text message changed everything.

“I hate to be the bearer of bad news, but Glacier Homes/Kindred Homes has decided to terminate the sales contract with you as of 12/15/2020,” the text reads.

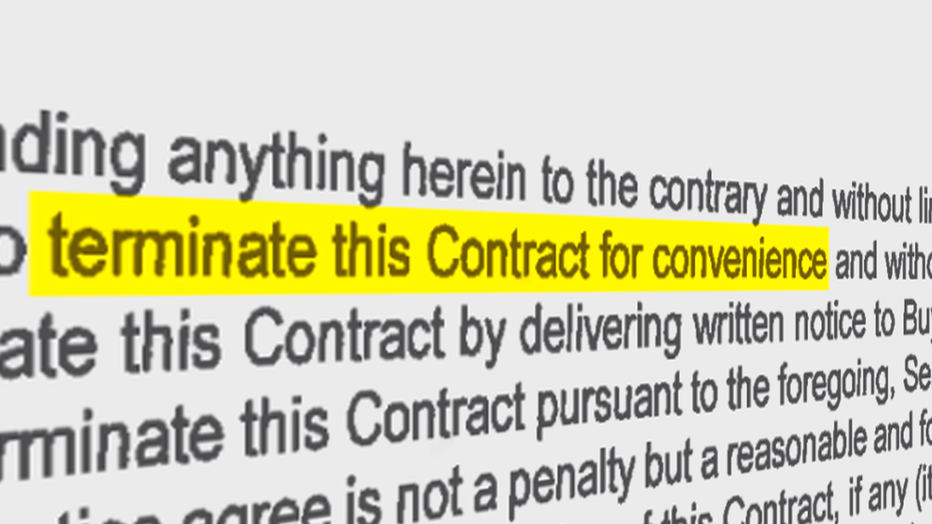

The builder backed down. A clause in the contract allowed them to “cancel for convenience” and put the house on the market.

The new price was $300,000 more than the price at which the Brundages had agreed to buy it.

Tracey, Donnell and their 1 and 4 year old sons were on the verge of becoming homeless.

“I’m still in disbelief even to this day,” Donnell said.

The couple are suing Horton Capital Properties, the parent company of Glacier and Kindred Homes.

The lawsuit alleges that the builder “coerced the Brundages into selling their home under the threat that the construction project would not proceed and on the basis that Glacier would deliver the final construction project.”

“It was conditional on our old house being sold,” Donnell said.

In the seller’s contract, Tracey and Donnell agreed to sell their current home before the builder boards their new home. If they hadn’t sold their home before the new construction was complete, there was an option to pay $2,000 per month in carry-over costs to the builder to save more time.

But in an email from the builder in September 2021, the couple were reminded “you need to go ahead and start working to sell your home.” Because that payment grace period is now gone, it says “senior management…will not grant contingency extensions.”

“Our previous house was contracted within a week, so that wasn’t the problem at all,” Donnell said.

Their buyer gave the Brundage family a lease so they could stay in their home past the date the builder announced their new home would be finished.

Then this day came.

“As of January 2022, the house isn’t even close to being finished,” Donnell said. “So we’re moving into an Airbnb.”

It was inconvenient for the couple and their children, but they thought it would soon be worth it once their forever home was completed.

Donnell commissioned a swimming pool company to design their new yard.

“They actually came out and surveyed the grounds,” he said. “Did us a full mockup of what they were going to do.”

Then, closing day arrived on April 15. It was supposed to be the home stretch. Kindred Homes told the couple they had to move the closure due to a delay.

“There was a delay on the mat that caused them to postpone the closing a week later to April 22,” Donnell said.

This was another problem for the young family. But after 16 months of moving, building and delays, they saw it as just one final speed bump.

Then this text message six days before the new closing date that the builder was canceling the sale. The escrow and upgrade money they had been holding for over a year would be refunded.

“No reason. No nothing. No nothing at all,” Donnell said. “Like, can you do this?”

FOX 4 has asked attorney Jason Freidman, who is not associated with the case, to review Horton Capital Properties’ sales agreement.

“It’s basically a deal to hold you hostage,” he said. “If you sign a contract like this, yes, you could be homeless.”

Unlike a sales contract promulgated by the Texas Real Estate Commission that provides protection for both buyer and seller, Freidman says the building contract, which Horton Capital demanded the Brundages sign, left them vulnerable. .

Importantly, the contract clearly reminds buyers that they can seek independent legal advice before signing. Tracey and Donnell didn’t.

HOUSING NEWS

FOX 4 asked Horton to explain the terms to us. They declined our interview request, saying “it would be inappropriate.”

Instead, Horton pointed to the “over 160 homes” they currently have under contract. They add that “cancellations are not what the company intends” that their “contract clearly addresses this possibility” which “may be part of the conduct of business”.

“In this contract, I would say there is no protection for the buyer,” Freidman said.

Section 10: Termination of Contract states that “Seller retains the right to terminate this contract for convenience and without regard to fault or breach”, which means that without notice and without any reason, the seller can opt out – and Horton did.

“It’s basically a get out of jail card,” Freidman said.

The contract limits the damages paid to the buyer to $500.

Try and complain? Not so fast. You have waived your right to a jury trial.

Rob the house with a title claim? No. You have no right.

Do it anyway? Sorry, you agreed in advance to allow the builder to remove it.

“Everything is fine here. Some of them are in bold,” Freidman said. “They know all the angles you’re going to attack from, and they’ve cut it here.”

So what is the solution ?

You can try to negotiate the terms of a construction contract before signing. You can choose not to buy.

Or like the Brundages, you might find yourself canceled for convenience.

MORE: On Your Side Segments

So why sue if the contract anticipates and blocks your recourses?

A judge could look at the wording and decide, although legal, the terms are so one-sided they shouldn’t be enforced.

A reminder to anyone entering into any type of contract: it must be reviewed by a lawyer.

Kindred Homes full statement:

“The residential real estate market is experiencing unprecedented constraints, from material shortages to rapidly rising costs. Like other residential home builders, Kindred Homes has been impacted by these market conditions. With these market conditions coupled with the surge in demand in the DFW real estate market and rising interest rates, buyers are feeling more stressed than ever about building or buying a new home.

It would not be appropriate to comment directly on a specific buyer’s transaction. At the time of this statement, Kindred Homes has more than 160 homes under contract in 22 neighborhoods across Texas. Occasionally, factors arise that lead to a decision to cancel a contract. Kindred Homes contracts clearly provide for this possibility. Cancellations are not what the company intends to do, but may be part of doing business in residential real estate.

It is important to Kindred Homes that our buyers are completely satisfied with the quality of construction of our homes. Kindred Homes focuses on building homes and helping buyers build a future with their families in their homes. – Carol Horton, CMO

Comments are closed.